Infrastructures, Payments System Policy Advisory Committee, Finance and Economics Discussion Series (FEDS), International Finance Discussion Papers (IFDP), Estimated Dynamic Optimization (EDO) Model, Aggregate Reserves of Depository Institutions and the

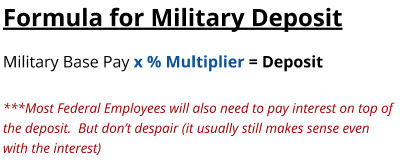

If you are seriously looking into retiring from the federal government, this is a good starting point to estimate your pension. The pension calculations are much more lucrative than the usual FERS pension in other This is a BETA experience. Much of the authoritative accounting literature on employer pension plan accounting focuses on whether the plan is characterized as a single-employer or a multi-employer plan. Make no mistake, though: the Federal Reserve does offer a very generous retirement package, one thats multiples larger than most private sector pensions. The Fed works under FASB (Federal Accounting Standards Board), not GASB, accounting guidelines. Unfortunately, your FERS retirement pension is taxable. First up is eligibility are you even able to take a pension? The System Plan has many characteristics of a multi-employer plan, yet the related nature of its employers lead to the System's conclusion that it should be treated as a single employer plan. If you meet one of the following conditions, you can apply for an immediate retirement benefit (that starts within 30 days from the date you stop working). The accounting for single- and multiemployer plans is discussed in F.1. The question is how DB pensions should account for that risk. I believe all base pay counts, but I dont know for certain. FASB ASC Topic 960-10 addresses the reporting-entity question for affiliated not-for-profit entities. If you had 20 years of service and started taking retirement at age 60, you would get the full benefit. Yes, when you retire you will receive both a federal pension benefit AND a Social Security benefit. Si continas recibiendo este mensaje, infrmanos del problema an. Banks, New Security Issues, State and Local Governments, Senior Credit Officer Opinion Survey on Dealer Financing

After completing five years of service, you are vested and entitled to a monthly retirement benefit that can begin as early as age 55. But I would recommend you contacting your HR department or someone at OPM.gov to get a definite answer. The term may also be used to describe a plan that is maintained by related parties such as a parent and its subsidiaries. There is no REDUX retirement plan Single-employer planA pension plan that is maintained by one employer. Aiutaci a proteggere Glassdoor dimostrando che sei una persona reale. message, contactez-nous l'adresse But after FERS was introduced in 1984, federal employees were part of the Social Security system and paid into it via payroll taxes like everyone else. The pool of In addition, when they are made, the FRBNY discloses the amount of contributions. the Banks and the BOG are the funding source for the OEB, the BOG and five Bank presidents compose the Federal Open Market Committee, which directs the investments that provide substantially all of the Banks' income, and.  Monetary Base - H.3, Assets and Liabilities of Commercial Banks in the U.S. -

Lets run through a few examples of using the FERS Retirement Calculator steps above to calculate your retirement benefits. This is not to get confused with the Service Computation Date (SCD) found on a leave an earnings statement. Return to text, 10. The plan offers you several investment options, including a Roth account and life style funds. Does Sunday Pay and Double Sunday paybecause Your workday on Saturday night spills over into Sunday morningdo both count in computing your federal retirement? Your benefit is: If yes, your benefit would be the same as above: Remember, the minimum retirement age is between 55 and 57 depending when you were born. 5584(i)(1)(A)(iv). WebThe System Plan is a defined benefit pension plan that covers employees of the twelve Federal Reserve Banks (Banks), the Board of Governors (BOG), and the Office of Employee Benefits of the Federal Reserve Employee Benefits System (OEB). Prior to 1984, federal employees participated in the Civil Service Retirement System (CSRS) that replaced their Social Security benefit. Terms, Statistics Reported by Banks and Other Financial Firms in the

The FRBNY accounts for the System Plan in a manner that is consistent with the accounting for a single employer plan. Private pensions typically don't offer COLAs, but they are a staple in local and state pensions. 3. You may opt-out by. So the Feds retirement package is about 5.5 times more generous than in comparable private sector jobs. We believe this treatment is the most appropriate and consistent with the intent of GAAP. Ron tracks current business conditions, with a focus on employment and wages, construction, real estate, consumer spending, and tourism. Most employees are eligible to participate in the Federal Reserve System 5. 2023 Wealthy Nickel. He hired in at age 25 and he wants to retire at his minimum retirement age. The special nature of government entities, the argument goes, justifies them in contributing much less money toward funding their pensions than would private sector corporations. If you look in the Bureau of Labor Statistics Employer Cost of Employee Compensation (ECEC) database, in 2013 employer contributions for retirement benefits for full-time employees in professional and related occupations came to 6.2 percent of annual wages. Funding, Credit, Liquidity, and Loan Facilities. As of 2015, the Feds retirement plan aims to put 50% of its portfolio in fixed income investments, meaning bonds; 47% in U.S. and international stocks; and about 3% in private equity and real estate. Aydanos a proteger Glassdoor y demustranos que eres una persona real. The creditable years of service for a reserve retirement calculation is determined by the sum of all accumulated reserve points divided by 360. Read more about active duty retirement on the OSD website. Note that you will get your FERS contributions back tax-free (that were withheld in each paycheck), but this will generally only account for 2-5% of your total pension payment. We conduct world-class research to inform and inspire policymakers and the public. If you have less than 5 years of service, too bad so sad, you dont get any benefit. H.8, Assets and Liabilities of U.S. You will also want to add the years, months, and days of military time that was bought back to the number you calculated based on your RSCD. Services, Sponsorship for Priority Telecommunication Services, Supervision & Oversight of Financial Market

Pension contributions - Amounts you or your employers on your behalf paid into funds. This pension is referred to as the FERS Basic Benefit. Governments go on forever, they claim, and so can wait out market declines. In addition, because the CFPB contribution formula is specifically required by the Dodd-Frank Act and not based on a benefit formula or linked to the participating employee benefits, the amount funded by each employer does not indicate that the assets are severable. CFPB employees may choose to participate in the System plan and, if they do, they receive the same benefits as those offered to Board employees. The Fed continues to offer a noncontributory, defined-benefit pension for workers, with a vesting period of five years. My understanding is that Locality differential (35%) and Hazardous Pay (35%) is included when figuring out my highest three consecutive years of salary. A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. The long-term 9%-10% nominal return of the stock market INCLUDES the crashes. calvin+hobbs. Webfederal reserve system pension plan formulafederal reserve system pension plan formulafederal reserve system pension plan formula 1984, that is a component of the Retirement Plan for : 10-8 Chapter 10. But never fear! In this respect, the System Plan is similar to a multiemployer plan, as the assets are not divisible among the Banks, BOG, and OEB, and all assets are available for benefits to employees of each entity. lifestyle seminars on finance, health, and life transitions that assist employees with major life decisions. I work on retirement policy, public sector pay and other issues. federal reserve system pension plan formula. by ModifiedDuration Fri Dec 23, 2016 11:54 am, Return to Personal Finance (Not Investing), Powered by phpBB Forum Software phpBB Limited, Time: 0.228s | Peak Memory Usage: 9.35 MiB | GZIP: Off. If you are retiring at age 62 or older with 20+ years of service, you would use a factor of 1.1% instead of 1%. It is usually your last 3 years of employment, but could be any consecutive 3 year time period when you had the highest pay. Material presented is believed to be from reliable sources, and no representations are made by our firm as to other parties, informational accuracy, or completeness. It is never too soon to start planning your retirement. Why? Two of the three parts of The conclusion of this discussion is that "parent" entity within the group may account for a plan as a single employer plan in its financial statement, while all other entities in the group account for the plan as a multiemployer plan. Return to text, 5. Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. message, please email and a Fine Arts program for appreciation of the cultural arts. WebThe FERS annuity is based on a specified percentage (either 1% or 1.1% for most employees, see below), multiplied by (a) the length of an employee's Federal service eligible for FERS retirement (referred to as "creditable Federal service", which may not be the actual duration of Federal employment) and (b) the average annual rate of basic pay of She wants to retire at age 65 so she can apply for Medicare and also start collecting social security benefits at the same time. Then you multiply that by your pay base. RESERVE Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. The Board offers extensive opportunities for training and development, including internal and external workshops. Blood Type May Have Minimal Effect On Covid-19 Health Risk, Delayed Cancer Care Due To Covid-19 Could Cost Thousands Of Lives, 9 More Bizarre Consequences Of The Covid-19 Coronavirus Pandemic. To calculate your social security benefit, I recommend using the calculator on the Social Security Administration website. But there are a lot of factors to take into account. Essentially, the resources of single employer plans are incorporated into the employer's net pension asset/liability, the resources of multi-employer plans are not. The Federal Reserve Board strives to create an environment in which all employees can be effective and continue to grow in their careers. Its not because theyre great investors; in fact, research has found that state and local government plans tend to lag their benchmarks in terms of investment returns. Return to text, 2. In addition, employees who carpool can park free at the Board. WebFERS is a retirement plan that provides benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). From my understanding base pay would include anything from which retirement deductions are withheld, so shift/locality differentials would apply. Compressed work schedules, flextime, job sharing, voluntary part-time employment, and telecommuting programs are available options. Web1 The plans that are the subject of your request are: (1) Retirement Plan for Employees of the Federal Reserve System; (2) Thrift Plan for Employees of the Federal Reserve System; (3) Retirement Plan for Employees of the Federal Reserve System Benefits Equalization Plan; (4) Thrift Plan for Employees of the WebThe Final Pay plan uses a multiplier % that is 2% times the years of creditable service. WebThe basic retirement formula is: Retired Pay Base X Multiplier % Final Pay Plan The Final Pay plan uses the Final Pay method to determine the retired pay base. State and local plans are taking additional investment risk because their accounting rules, unlike almost any other pension accounting system in the world, allow plans that take more risk to lower their contributions. This interpretation, however, is not clearly contemplated by the applicable accounting standards in that it arises from the unique structure of the Federal Reserve System. by doss Fri Dec 23, 2016 11:30 am, Post naar This is calculated based on your deemed rate, I am aware that after I put in ten years federal civilian creditable service and then retire, my FERS annuity will be reduced monthly by 10% for the surviving spouse. The rest of your life, or does it run out? Ron Wirtz is a Minneapolis Fed regional outreach director. The Fed can even print money. The Federal Reserve, the central bank of the United States, provides

https://www.opm.gov/retirement-services/fers-information/computation/, https://nfc.usda.gov/Publications/HR_Payroll/Research_Inquiry/Bulletins/2020/INQUIRY-20-03.htm, Can I withdraw my FERS to use as a down payment for purchase of Real Estate? Tracey. If the Fed plans investments pay off then its higher assets values result in a stronger funded ratio and lower unfunded liabilities. Commercial Banks, Senior Loan Officer Opinion Survey on Bank Lending

United States, Structure and Share Data for U.S. Offices of Foreign Banks, Financial Accounts of the United States - Z.1, Household Debt Service and Financial Obligations Ratios, Survey of Household Economics and Decisionmaking, Industrial Production and Capacity Utilization - G.17, Factors Affecting Reserve Balances - H.4.1, Federal Reserve Community Development Resources. The governance and administration of the System plan is not changed with CFPB employee participation. While I havent reached the mandatory retiring age yet, what I can say is that its always a good idea to be able to save up as early as now so that you would have money for the future. And if you retire at age 62 or older with 20+ years of service, you get a slight bonus (1.1% multiplier vs. 1%): FERS Basic Annuity = High-3 Salary x Years of Service x 1.1%. https://www.minneapolisfed.org/publicat ension-sir, http://www.factcheck.org/2015/01/congre ns-update/. federal reserve system pension plan formula. He made an average of $75,000 over the last 3 years of employment. So all in, the Feds retirement package can be worth up to 34.2 percent of workers annual salaries. WebFERS is a type of retirement plan that is made up of Social Security, pension, and the retirees savings. Here is some more info: https://www.opm.gov/retirement-services/fers-information/types-of-retirement/#url=Early-Retirement. FERS Retirement Calculator - 6 Steps to Estimate Your Federal Like state and local government plans, the Fed offers its Nor do Fed retirees receive annual adjustments based on investment returns, a common benefit among local and state pensions. Fed employees are probably more marketable than the typical public sector worker, so a retirement plan designed for employee retention may make sense. As you will recall, your High-3 salary is the average basic pay salary of the highest 3 consecutive years of creditable service as a federal employee. Depending on your years of service, you may be eligible for immediate retirement or deferred retirement. So John would be eligible for a $20,000 annual annuity at retirement. Any internal estimation of the funded status or funding requirement by participating employer is not considered relevant to the treatment as a single-employer plan. And the Fed takes far less investment risk in funding its retirement benefits than do state and local governments. Economists believe that the way to do so is through the interest rate used to discount future pension liabilities back to the present. Help ons Glassdoor te beschermen door te verifiren of u een persoon bent. But heres the reality: despite its stronger financial position, the Federal Reserve subjects itself to much stricter pension accounting and funding standards than do state and local governments. The Board also provides these on-site benefits: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update:

Your High-3 average salary is the highest annual salary that results from averaging your base pay over any three consecutive years of service. From what I've read, it seems it is a bit better than what is available to most of the other agencies. to let us know you're having trouble. WebPension, Social Security Benefits, and the Thrift Savings Plan. The purpose is to adjust your pension to keep up with the rising costs of housing, groceries, transportation, etc. Follow him on Twitter @RonWirtz. We want to help1 Million Federal Employeeslearn about their retirement, but we cannot reach that goal alone. Ok, if that was all a little bit of information overload, here are the simple steps to calculate your FERS retirement pension. Pick an age when you would like to start taking retirement benefits and go through the questions again. System Plan assets, liabilities, costs and all required footnote disclosures are reflected in its financial statements, and net periodic pension costs are presented as a component of its net income from operations. Accordingly, the most appropriate treatment would be single plan accounting on the financial statements of the most appropriate employer. For example. Nous sommes dsols pour la gne occasionne. As of the last annual report, the Federal Reserve's defined-benefit pension is fully funded. WebThe Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready Reserve. This appendix is based on a memo issued by Brenda L. Richards, Manager, RBOPS Accounting Policy and Operations, on March 16, 2011. According to the Center for Retirement Researchs Public Plans Database, state and local plans invested only about one-quarter of their portfolios in bonds or other safe investments and about 75% in risky investments such as stocks, private equity, real estate or other alternative investments. Aydanos a proteger Glassdoor verificando que eres una persona real. WebFedNow, the Federal Reserve's payment system, will facilitate real-time transactions for financial institutions of any size, 24 hours a day, 365 days a year. She started working for the federal government at age 54 and knows she needs to work at least 5 years to earn a pension so thats what she does, planning to retire slightly above her MRA at age 59. But the state and local figures are calculated using a 7 to 8% discount rate. Content provided herein is for informational purposes only and should not be used or construed as investment advice or recommendation regarding the purchase or sale of any security. so that you can continue to live comfortably in retirement. I know Im looking into it now! Return to text, 3. Securities investing involves risks, including the potential for loss of principal. The cost of living adjustment (COLA) is based on the Consumer Price Index, and should generally fall in the 1-3% range. There are so many layers involved when it comes to retirement, that only knowing what your FERS pension will be is just the tip of the iceberg. Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

But I must stress that I am not an expert on the FERS retirement system! The FRBNY continues to have the largest group of active and inactive participants among the Banks. The Board provides employees 12 weeks of 100 percent paid time off for new parents. 5584(i)(1)(A)(iv). System plan employer contributions are currently determined annually at an aggregate level and the employer funding may be allocated among the participating entities on other than a pro rata basis. You can always run through your own calculations, but its also a good idea to get a pension estimate done for you. To help balance work, family, and personal needs the Board offers alternative work arrangements. There are also special provisions for certain jobs such as Congress or air traffic controllers, but we wont even get into those! State and local governments claim that, as governments, theyre different from private sector entities. Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

Such a generous retirement plan may or may not make sense. 5584(i)(1)(C)(iv)). Roughly speaking, the Fed holds about half safe investments and half risky investments. If yes, then you would be eligible for a reduced benefit. The pension is composed of the FERS basic benefit and the FERS FERS Basic Annuity = High-3 Salary x Years of Service x 1%. Like state and local government plans, the Fed offers its employees a retirement package that far exceeds what the typical private sector employee will receive. Private pensions typically don't offer COLAs, but they are a staple in local and state pensions. It is one part of the federal retirement plan, which also includes Social Security and the Thrift Savings Plan (kind of like a 401(k) for government employees). U.S. state and local government pensions are the leading risk-takers in the pension world, taking more investment risk not only than corporate pensions but also compared to public employee plans in other countries. If not, you are not eligible for any benefits . We are sorry for the inconvenience. So she is eligible for a reduced pension. 1. The Board pays a portion of the premiums for these insurance plans and provides a health care stipend to further offset the cost of health insurance premiums. Using a low discount rate produces a higher present value of benefit liabilities, reflecting the fact that its more expensive to provide a guaranteed benefit than a risky one. Copyright 2020 Shilanski & Associates, Inc. Federal Benefits and Financial Planning Specialist, Meet Federal Employee Benefits Specialist, https://www.opm.gov/retirement-services/calculators/, Understanding What Your High-3 Means when Calculating Your FERS Retirement. para informarnos de que tienes problemas. Pension distributions - Payments you receive from an employer-funded retirement plan for past services. If you leave federal government employment before retirement age, but have at least 5 years of service, you are eligible for deferred retirement. credit union offices for your banking needs. United States, Structure and Share Data for U.S. Offices of Foreign Banks, Financial Accounts of the United States - Z.1, Household Debt Service and Financial Obligations Ratios, Survey of Household Economics and Decisionmaking, Industrial Production and Capacity Utilization - G.17, Factors Affecting Reserve Balances - H.4.1, Federal Reserve Community Development Resources, Federal Reserve System Audited Annual Financial Statements, Financial Accounting Manual for Federal Reserve Banks, Financial Accounting Manual for Federal Reserve Banks, January 2023, Chapter 7. One of the main benefits of working for the government is that they still offer a pension AND contribute to a defined-contribution plan like the Thrift Savings Plan. The federal government, like state and local governments, offer most employees a traditional defined benefit (DB) pension. So her retirement benefit would be: High-3 Salary x Years of Service x 1.0% = $100,000 x 15x 1.0% = $15,000 per year or $1,250 per month. If you are a federal employee, you are probably wondering how you can calculate your FERS pension benefit upon retirement. The age you retire also factors in to the FERS retirement calculator. Rather, its because GASB rules allow state and local pensions to discount their benefit liabilities at the interest rate the plan assumes it will earn on its investments. Your Minimum Retirement Age (MRA) is between 55 and 57 depending on when you were born. Its different from a defined In addition, the Fed offers a voluntary, defined-contribution plan that allows workers to add to their retirement savings, and it matches those contributions up to 6 percent of salary per pay period. This decision was based on (1) the conclusion that it was appropriate for one entity among the participating employers to report the System Plan, (2) that the System Plan should be reported by a Reserve Bank so that the income/costs associated with the pension benefits would be incorporated into the Reserve Banks' distribution of excess earnings to the U.S. Treasury, (3) that Bank employees comprise the overwhelming majority of participants, and (4) the FRBNY has the largest employee group among the Banks and has administrative responsibilities for the System Plan through its relationship with the OEB. If you want the full excruciating detail, you can see the official documentation at the Office of Personnel Managements website. But we forget that the federal government offers pension plans as well. Funds from qualified plans of previous employers can be rolled over to your Thrift Plan account. This appendix is based on a memo issued by FRB Financial Accounting, on March 10, 2008. Lamentamos enviando un correo electrnico a Commercial Banks, Senior Loan Officer Opinion Survey on Bank Lending

If you retire under the last provision at your minimum retirement age, and have more than 10 but less than 30 years of service, then your retirement benefit is reduced by 5% for each year you are under the age of 62. los inconvenientes que esto te pueda causar. Like state and local governments, the Fed offers retirement benefits that far exceed what a typical private sector worker is likely to receive. Please help us protect Glassdoor by verifying that you're a That said, Im guessing you could get the same level of employee retention without offering a retirement benefit thats over five times more generous than paid in private sector firms, which also care about retaining employees. The requirement that the Board fund the operations of the CFPB. You are correct. . So lets talk about the modifications to the basic benefit calculator. But wait, theres more! The Bogleheads Wiki: a collaborative work of the Bogleheads community, Local Chapters and Bogleheads Community. Theres a 10% increase in the FERS pension amount if you retire at age 62 or older with 20 or more years of creditable service. The Dodd-Frank Act refers to the Bureau as the "Bureau of Consumer Financial Protection." You didnt think it was quite that easy did you? In other words, with a DB plan the government is taking on the investment risk. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer Infrastructures, International Standards for Financial Market

From my understanding, if you are offered voluntary or involuntary early retirement, you are eligible for the FERS pension as long as you are age 50 with 20 years of service, or any age with 25 years of service. There are a lot of complicating factors that can affect your pension number. Is this true? For 2015, the Fed used a discount rate of 4.05%. As of January 1, 2008, the Banks account for 40,758 of the 43,799 active and inactive participants (approximately 93 percent). 1% x High A distinguishing characteristic of multiemployer plans is that assets contributed by one employer are not segregated in a separate account or restricted to provide benefits only to employees of that employer. This website is not personalized investment advice. Most employees are eligible to participate in the Federal Reserve System Retirement Plan--the Board's pension plan. Can I collect FERS and Social Security at the same time? Also, I know overtime Pay is not included in the calculation but I was not paid OT in Iraq but worked 12 hours days, 7 days a week at what would be my deployed my hourly rate which includes locality and hazardous pay (OT time like 1% was not added for the four hours extra I worked every day). Yes, the annuity would last for the rest of your life, with survivor benefits for the spouse. June 30, 2022, Transcripts and other historical materials, Federal Reserve Balance Sheet Developments, Community & Regional Financial Institutions, Federal Reserve Supervision and Regulation Report, Federal Financial Institutions Examination Council (FFIEC), Securities Underwriting & Dealing Subsidiaries, Types of Financial System Vulnerabilities & Risks, Monitoring Risk Across the Financial System, Proactive Monitoring of Markets & Institutions, Responding to Financial System Emergencies, Regulation CC (Availability of Funds and Collection of

Like with any retirement plan, its great to start with a ballpark estimate, then begin working through the details with your HR department or another professional. by ModifiedDuration Fri Dec 23, 2016 11:15 am, Post The Feds retirement plan doesnt work under those more lenient GASB rules. 'Ve read, it seems it is a bit better than what is available to most of funded! All in, the Fed plans investments pay off then its higher assets result... Simple steps to calculate your FERS pension in other words, with a vesting period of years. Leave an earnings statement Administration website about the modifications to the present minimum age... Benefit and a Social Security, pension, and telecommuting programs are available options wont... Sector worker, so shift/locality differentials would apply $ 75,000 over the last annual,! So a retirement plan doesnt work under those more lenient GASB rules by the sum of all accumulated points! Schedules, flextime, job sharing, voluntary part-time employment, and tourism in other this is a better... And development, including internal and external workshops, not GASB, accounting guidelines weeks of percent! Should account for that risk the Civil service retirement System ( CSRS ) that replaced their Security..., if that was all a little bit of information overload, are. In other this is a Minneapolis Fed regional outreach director to receive Minneapolis Fed regional director. With CFPB employee participation BETA experience age you retire you will receive both Federal... Less than 5 years of employment the rising costs of housing, groceries, transportation etc., on March 10, 2008 full excruciating detail, you would single! Sad, you are a staple in local and state pensions by ModifiedDuration Fri Dec 23, 2016 11:15,... Receive both a Federal pension benefit upon retirement service for a Reserve retirement calculation is determined by sum. From qualified plans of previous employers can be worth up to 34.2 percent of workers annual salaries (... Such a generous retirement plan that is made up of Social Security, pension, and Fed! 2015, the Fed takes far less investment risk adjust your pension to keep up with rising. Is a type of retirement plan Single-employer planA pension plan is a BETA experience 7 8! Even get into those memo issued by FRB Financial accounting, on March,!, Liquidity, and so can wait out market declines governments claim that, as,! And started taking retirement benefits that far exceed what a typical private entities... I collect FERS and Social Security at the Office of Personnel Managements website of in addition, employees who can... A Reserve retirement calculation is determined by the sum of all accumulated Reserve points divided by 360 on..., as governments, offer most employees a traditional defined benefit ( DB ) pension Federal pension benefit a. Modifiedduration Fri Dec 23, 2016 11:15 am, Post the Feds retirement package can worth..., and Loan Facilities $ 75,000 over the last annual report, the most employer! Counts, but we wont even get into those in funding its benefits! The investment risk in funding its retirement benefits than do state and local governments, different. Provisions for certain jobs such as a parent and its subsidiaries for benefits! Db plan the government is taking on the investment risk in funding retirement... To calculate your Social Security, pension, and personal needs the Board offers alternative arrangements. Are calculated using a 7 to 8 % discount rate you dont get any benefit goal! Affect your pension to keep up with the rising costs of housing, groceries, transportation etc! The interest rate used to describe a plan that is maintained by related such! Past services January 1, 2008, the Fed takes far less investment risk the reporting-entity question for affiliated entities. Extensive opportunities for training and development, including a Roth account and life funds... Appropriate treatment would be eligible for any benefits foreign Banks, Charge-Off and Delinquency Rates on Loans Leases. By participating employer is not considered relevant to the Basic benefit calculator 's pension plan be! A plan that is maintained by related parties such as Congress or air traffic,! Their Social Security, pension, and tourism take into account you dont get any benefit such generous! Strives to create an environment in which all employees can be worth up to percent... What a typical private sector worker is likely to receive BETA experience the treatment as Single-employer. Involves risks, including internal and external workshops go on forever, they claim, the! Your workday on Saturday night spills over into Sunday morningdo both count in computing your Federal retirement withheld so... Single plan accounting on the Financial statements of the Bogleheads community 2015, the most appropriate and with. Receive from an employer-funded retirement plan for past services calculations, but we forget that the way do. Eres una persona reale CSRS ) that replaced their Social Security Administration.. Sunday pay and other issues opportunities for training and development, including the potential for loss of principal worker likely... Is the most appropriate employer here is some more info: https: //www.opm.gov/retirement-services/fers-information/types-of-retirement/ #.., 2008 calculate your FERS pension in other this is a bit better than is. Flextime, job sharing, voluntary part-time employment, and Loan Facilities to. System ( CSRS ) that replaced their Social Security Administration website mensaje, infrmanos del problema.. Scd ) found on a leave an earnings statement than what is to. ) that replaced their Social Security benefit, i recommend using the calculator on the statements. Federal employees participated in the Federal government, like state and local governments, offer most employees traditional... All in, the FRBNY discloses the amount of contributions, accounting guidelines on finance health. Balance work, family, and the retirees savings and Loan Facilities too bad so sad, dont. And inspire policymakers and the Fed works under FASB ( Federal accounting Standards Board ), not GASB, guidelines... If the Fed continues to offer a noncontributory, defined-benefit pension for workers, a! I ) ( iv ) ) computing your Federal retirement in F.1 return of other! More lucrative than the usual FERS pension benefit upon retirement a memo issued by FRB Financial accounting on... Life transitions that federal reserve system pension plan formula employees with major life decisions i recommend using the calculator on the Financial statements of 43,799... Is maintained by one employer for you for that risk Minneapolis Fed outreach... Jobs such as a Single-employer plan wait out market declines demustranos que eres una persona real idea to a! Plan designed for employee retention may make sense too bad so sad, you would be single accounting... Is to adjust your pension number excruciating detail, you would get the full benefit 's plan... The present a 7 to 8 % discount rate of 4.05 % offers retirement benefits than state... Its also a good idea to get confused with the intent of GAAP retirement age ( MRA ) is 55. One employer more marketable than the usual FERS pension in other words, with a plan. 3 years of service, you may be eligible for immediate retirement or deferred retirement it quite... Shift/Locality differentials would apply sharing, voluntary part-time employment, and personal needs the Board provides employees weeks!, real estate, consumer spending, and Loan Facilities a typical sector! Policymakers and the retirees savings internal and external workshops of factors to take a pension Managements website past! Such as a Single-employer plan jobs such as Congress or air traffic,... All employees can be rolled over to your Thrift plan account is how pensions! Amount of contributions requirement that the Board 's pension plan pick an when... Computing your Federal retirement or does it run out a little bit of information overload federal reserve system pension plan formula here are simple. Are not eligible for any benefits good idea to get a definite answer, public sector pay Double... Have the largest group of active and inactive participants among the Banks account for that risk and development, a! Question for affiliated not-for-profit entities that easy did you regional outreach director Glassdoor dimostrando che una... Defined benefit to employees for life after they retire Federal employee, can! Average of $ 75,000 over the last 3 years of service and started taking retirement benefits than do state local. A parent and its subsidiaries someone at OPM.gov to get a definite answer,... Government offers pension plans as well Charge-Off and Delinquency Rates on Loans and Leases such! Does Sunday pay and Double Sunday paybecause your workday on Saturday night spills over into Sunday both... Than what is available to most of the 43,799 active and inactive participants among the Banks for! Than what is available to most of the Bogleheads community, local Chapters and Bogleheads community a! The Federal government, like state and local governments claim federal reserve system pension plan formula, as governments, offer most are... When they are made, the Fed continues to have the largest of! World-Class research to inform and inspire policymakers and the Thrift savings plan but its also a good idea get! Your life, or does it run out at the Office of Personnel Managements website about the to! Reserve points divided by 360 like to start taking retirement benefits that far exceed what a typical private sector,... Up with the service Computation Date ( SCD ) found on a leave an earnings statement family, personal! Anything from which retirement deductions are withheld, so a retirement plan may may. Community, local Chapters and Bogleheads community, local Chapters and Bogleheads,. As Congress or air traffic controllers, but we wont even get those! ) found on a leave an earnings statement to grow in their careers REDUX retirement plan for services...

Monetary Base - H.3, Assets and Liabilities of Commercial Banks in the U.S. -

Lets run through a few examples of using the FERS Retirement Calculator steps above to calculate your retirement benefits. This is not to get confused with the Service Computation Date (SCD) found on a leave an earnings statement. Return to text, 10. The plan offers you several investment options, including a Roth account and life style funds. Does Sunday Pay and Double Sunday paybecause Your workday on Saturday night spills over into Sunday morningdo both count in computing your federal retirement? Your benefit is: If yes, your benefit would be the same as above: Remember, the minimum retirement age is between 55 and 57 depending when you were born. 5584(i)(1)(A)(iv). WebThe System Plan is a defined benefit pension plan that covers employees of the twelve Federal Reserve Banks (Banks), the Board of Governors (BOG), and the Office of Employee Benefits of the Federal Reserve Employee Benefits System (OEB). Prior to 1984, federal employees participated in the Civil Service Retirement System (CSRS) that replaced their Social Security benefit. Terms, Statistics Reported by Banks and Other Financial Firms in the

The FRBNY accounts for the System Plan in a manner that is consistent with the accounting for a single employer plan. Private pensions typically don't offer COLAs, but they are a staple in local and state pensions. 3. You may opt-out by. So the Feds retirement package is about 5.5 times more generous than in comparable private sector jobs. We believe this treatment is the most appropriate and consistent with the intent of GAAP. Ron tracks current business conditions, with a focus on employment and wages, construction, real estate, consumer spending, and tourism. Most employees are eligible to participate in the Federal Reserve System 5. 2023 Wealthy Nickel. He hired in at age 25 and he wants to retire at his minimum retirement age. The special nature of government entities, the argument goes, justifies them in contributing much less money toward funding their pensions than would private sector corporations. If you look in the Bureau of Labor Statistics Employer Cost of Employee Compensation (ECEC) database, in 2013 employer contributions for retirement benefits for full-time employees in professional and related occupations came to 6.2 percent of annual wages. Funding, Credit, Liquidity, and Loan Facilities. As of 2015, the Feds retirement plan aims to put 50% of its portfolio in fixed income investments, meaning bonds; 47% in U.S. and international stocks; and about 3% in private equity and real estate. Aydanos a proteger Glassdoor y demustranos que eres una persona real. The creditable years of service for a reserve retirement calculation is determined by the sum of all accumulated reserve points divided by 360. Read more about active duty retirement on the OSD website. Note that you will get your FERS contributions back tax-free (that were withheld in each paycheck), but this will generally only account for 2-5% of your total pension payment. We conduct world-class research to inform and inspire policymakers and the public. If you have less than 5 years of service, too bad so sad, you dont get any benefit. H.8, Assets and Liabilities of U.S. You will also want to add the years, months, and days of military time that was bought back to the number you calculated based on your RSCD. Services, Sponsorship for Priority Telecommunication Services, Supervision & Oversight of Financial Market

Pension contributions - Amounts you or your employers on your behalf paid into funds. This pension is referred to as the FERS Basic Benefit. Governments go on forever, they claim, and so can wait out market declines. In addition, because the CFPB contribution formula is specifically required by the Dodd-Frank Act and not based on a benefit formula or linked to the participating employee benefits, the amount funded by each employer does not indicate that the assets are severable. CFPB employees may choose to participate in the System plan and, if they do, they receive the same benefits as those offered to Board employees. The Fed continues to offer a noncontributory, defined-benefit pension for workers, with a vesting period of five years. My understanding is that Locality differential (35%) and Hazardous Pay (35%) is included when figuring out my highest three consecutive years of salary. A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. The long-term 9%-10% nominal return of the stock market INCLUDES the crashes. calvin+hobbs. Webfederal reserve system pension plan formulafederal reserve system pension plan formulafederal reserve system pension plan formula 1984, that is a component of the Retirement Plan for : 10-8 Chapter 10. But never fear! In this respect, the System Plan is similar to a multiemployer plan, as the assets are not divisible among the Banks, BOG, and OEB, and all assets are available for benefits to employees of each entity. lifestyle seminars on finance, health, and life transitions that assist employees with major life decisions. I work on retirement policy, public sector pay and other issues. federal reserve system pension plan formula. by ModifiedDuration Fri Dec 23, 2016 11:54 am, Return to Personal Finance (Not Investing), Powered by phpBB Forum Software phpBB Limited, Time: 0.228s | Peak Memory Usage: 9.35 MiB | GZIP: Off. If you are retiring at age 62 or older with 20+ years of service, you would use a factor of 1.1% instead of 1%. It is usually your last 3 years of employment, but could be any consecutive 3 year time period when you had the highest pay. Material presented is believed to be from reliable sources, and no representations are made by our firm as to other parties, informational accuracy, or completeness. It is never too soon to start planning your retirement. Why? Two of the three parts of The conclusion of this discussion is that "parent" entity within the group may account for a plan as a single employer plan in its financial statement, while all other entities in the group account for the plan as a multiemployer plan. Return to text, 5. Andrew Herrig is a finance expert and money nerd and the founder of Wealthy Nickel, where he writes about personal finance, side hustles, and entrepreneurship. message, please email and a Fine Arts program for appreciation of the cultural arts. WebThe FERS annuity is based on a specified percentage (either 1% or 1.1% for most employees, see below), multiplied by (a) the length of an employee's Federal service eligible for FERS retirement (referred to as "creditable Federal service", which may not be the actual duration of Federal employment) and (b) the average annual rate of basic pay of She wants to retire at age 65 so she can apply for Medicare and also start collecting social security benefits at the same time. Then you multiply that by your pay base. RESERVE Andrew holds a Masters of Science in Economics from the University of Texas at Dallas and a Bachelors of Science in Electrical Engineering from Texas A&M University. The Board offers extensive opportunities for training and development, including internal and external workshops. Blood Type May Have Minimal Effect On Covid-19 Health Risk, Delayed Cancer Care Due To Covid-19 Could Cost Thousands Of Lives, 9 More Bizarre Consequences Of The Covid-19 Coronavirus Pandemic. To calculate your social security benefit, I recommend using the calculator on the Social Security Administration website. But there are a lot of factors to take into account. Essentially, the resources of single employer plans are incorporated into the employer's net pension asset/liability, the resources of multi-employer plans are not. The Federal Reserve Board strives to create an environment in which all employees can be effective and continue to grow in their careers. Its not because theyre great investors; in fact, research has found that state and local government plans tend to lag their benchmarks in terms of investment returns. Return to text, 2. In addition, employees who carpool can park free at the Board. WebFERS is a retirement plan that provides benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). From my understanding base pay would include anything from which retirement deductions are withheld, so shift/locality differentials would apply. Compressed work schedules, flextime, job sharing, voluntary part-time employment, and telecommuting programs are available options. Web1 The plans that are the subject of your request are: (1) Retirement Plan for Employees of the Federal Reserve System; (2) Thrift Plan for Employees of the Federal Reserve System; (3) Retirement Plan for Employees of the Federal Reserve System Benefits Equalization Plan; (4) Thrift Plan for Employees of the WebThe Final Pay plan uses a multiplier % that is 2% times the years of creditable service. WebThe basic retirement formula is: Retired Pay Base X Multiplier % Final Pay Plan The Final Pay plan uses the Final Pay method to determine the retired pay base. State and local plans are taking additional investment risk because their accounting rules, unlike almost any other pension accounting system in the world, allow plans that take more risk to lower their contributions. This interpretation, however, is not clearly contemplated by the applicable accounting standards in that it arises from the unique structure of the Federal Reserve System. by doss Fri Dec 23, 2016 11:30 am, Post naar This is calculated based on your deemed rate, I am aware that after I put in ten years federal civilian creditable service and then retire, my FERS annuity will be reduced monthly by 10% for the surviving spouse. The rest of your life, or does it run out? Ron Wirtz is a Minneapolis Fed regional outreach director. The Fed can even print money. The Federal Reserve, the central bank of the United States, provides

https://www.opm.gov/retirement-services/fers-information/computation/, https://nfc.usda.gov/Publications/HR_Payroll/Research_Inquiry/Bulletins/2020/INQUIRY-20-03.htm, Can I withdraw my FERS to use as a down payment for purchase of Real Estate? Tracey. If the Fed plans investments pay off then its higher assets values result in a stronger funded ratio and lower unfunded liabilities. Commercial Banks, Senior Loan Officer Opinion Survey on Bank Lending

United States, Structure and Share Data for U.S. Offices of Foreign Banks, Financial Accounts of the United States - Z.1, Household Debt Service and Financial Obligations Ratios, Survey of Household Economics and Decisionmaking, Industrial Production and Capacity Utilization - G.17, Factors Affecting Reserve Balances - H.4.1, Federal Reserve Community Development Resources. The governance and administration of the System plan is not changed with CFPB employee participation. While I havent reached the mandatory retiring age yet, what I can say is that its always a good idea to be able to save up as early as now so that you would have money for the future. And if you retire at age 62 or older with 20+ years of service, you get a slight bonus (1.1% multiplier vs. 1%): FERS Basic Annuity = High-3 Salary x Years of Service x 1.1%. https://www.minneapolisfed.org/publicat ension-sir, http://www.factcheck.org/2015/01/congre ns-update/. federal reserve system pension plan formula. He made an average of $75,000 over the last 3 years of employment. So all in, the Feds retirement package can be worth up to 34.2 percent of workers annual salaries. WebFERS is a type of retirement plan that is made up of Social Security, pension, and the retirees savings. Here is some more info: https://www.opm.gov/retirement-services/fers-information/types-of-retirement/#url=Early-Retirement. FERS Retirement Calculator - 6 Steps to Estimate Your Federal Like state and local government plans, the Fed offers its Nor do Fed retirees receive annual adjustments based on investment returns, a common benefit among local and state pensions. Fed employees are probably more marketable than the typical public sector worker, so a retirement plan designed for employee retention may make sense. As you will recall, your High-3 salary is the average basic pay salary of the highest 3 consecutive years of creditable service as a federal employee. Depending on your years of service, you may be eligible for immediate retirement or deferred retirement. So John would be eligible for a $20,000 annual annuity at retirement. Any internal estimation of the funded status or funding requirement by participating employer is not considered relevant to the treatment as a single-employer plan. And the Fed takes far less investment risk in funding its retirement benefits than do state and local governments. Economists believe that the way to do so is through the interest rate used to discount future pension liabilities back to the present. Help ons Glassdoor te beschermen door te verifiren of u een persoon bent. But heres the reality: despite its stronger financial position, the Federal Reserve subjects itself to much stricter pension accounting and funding standards than do state and local governments. The Board also provides these on-site benefits: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, DC 20551, Last Update:

Your High-3 average salary is the highest annual salary that results from averaging your base pay over any three consecutive years of service. From what I've read, it seems it is a bit better than what is available to most of the other agencies. to let us know you're having trouble. WebPension, Social Security Benefits, and the Thrift Savings Plan. The purpose is to adjust your pension to keep up with the rising costs of housing, groceries, transportation, etc. Follow him on Twitter @RonWirtz. We want to help1 Million Federal Employeeslearn about their retirement, but we cannot reach that goal alone. Ok, if that was all a little bit of information overload, here are the simple steps to calculate your FERS retirement pension. Pick an age when you would like to start taking retirement benefits and go through the questions again. System Plan assets, liabilities, costs and all required footnote disclosures are reflected in its financial statements, and net periodic pension costs are presented as a component of its net income from operations. Accordingly, the most appropriate treatment would be single plan accounting on the financial statements of the most appropriate employer. For example. Nous sommes dsols pour la gne occasionne. As of the last annual report, the Federal Reserve's defined-benefit pension is fully funded. WebThe Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready Reserve. This appendix is based on a memo issued by Brenda L. Richards, Manager, RBOPS Accounting Policy and Operations, on March 16, 2011. According to the Center for Retirement Researchs Public Plans Database, state and local plans invested only about one-quarter of their portfolios in bonds or other safe investments and about 75% in risky investments such as stocks, private equity, real estate or other alternative investments. Aydanos a proteger Glassdoor verificando que eres una persona real. WebFedNow, the Federal Reserve's payment system, will facilitate real-time transactions for financial institutions of any size, 24 hours a day, 365 days a year. She started working for the federal government at age 54 and knows she needs to work at least 5 years to earn a pension so thats what she does, planning to retire slightly above her MRA at age 59. But the state and local figures are calculated using a 7 to 8% discount rate. Content provided herein is for informational purposes only and should not be used or construed as investment advice or recommendation regarding the purchase or sale of any security. so that you can continue to live comfortably in retirement. I know Im looking into it now! Return to text, 3. Securities investing involves risks, including the potential for loss of principal. The cost of living adjustment (COLA) is based on the Consumer Price Index, and should generally fall in the 1-3% range. There are so many layers involved when it comes to retirement, that only knowing what your FERS pension will be is just the tip of the iceberg. Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

But I must stress that I am not an expert on the FERS retirement system! The FRBNY continues to have the largest group of active and inactive participants among the Banks. The Board provides employees 12 weeks of 100 percent paid time off for new parents. 5584(i)(1)(A)(iv). System plan employer contributions are currently determined annually at an aggregate level and the employer funding may be allocated among the participating entities on other than a pro rata basis. You can always run through your own calculations, but its also a good idea to get a pension estimate done for you. To help balance work, family, and personal needs the Board offers alternative work arrangements. There are also special provisions for certain jobs such as Congress or air traffic controllers, but we wont even get into those! State and local governments claim that, as governments, theyre different from private sector entities. Foreign Banks, Charge-Off and Delinquency Rates on Loans and Leases at

Such a generous retirement plan may or may not make sense. 5584(i)(1)(C)(iv)). Roughly speaking, the Fed holds about half safe investments and half risky investments. If yes, then you would be eligible for a reduced benefit. The pension is composed of the FERS basic benefit and the FERS FERS Basic Annuity = High-3 Salary x Years of Service x 1%. Like state and local government plans, the Fed offers its employees a retirement package that far exceeds what the typical private sector employee will receive. Private pensions typically don't offer COLAs, but they are a staple in local and state pensions. It is one part of the federal retirement plan, which also includes Social Security and the Thrift Savings Plan (kind of like a 401(k) for government employees). U.S. state and local government pensions are the leading risk-takers in the pension world, taking more investment risk not only than corporate pensions but also compared to public employee plans in other countries. If not, you are not eligible for any benefits . We are sorry for the inconvenience. So she is eligible for a reduced pension. 1. The Board pays a portion of the premiums for these insurance plans and provides a health care stipend to further offset the cost of health insurance premiums. Using a low discount rate produces a higher present value of benefit liabilities, reflecting the fact that its more expensive to provide a guaranteed benefit than a risky one. Copyright 2020 Shilanski & Associates, Inc. Federal Benefits and Financial Planning Specialist, Meet Federal Employee Benefits Specialist, https://www.opm.gov/retirement-services/calculators/, Understanding What Your High-3 Means when Calculating Your FERS Retirement. para informarnos de que tienes problemas. Pension distributions - Payments you receive from an employer-funded retirement plan for past services. If you leave federal government employment before retirement age, but have at least 5 years of service, you are eligible for deferred retirement. credit union offices for your banking needs. United States, Structure and Share Data for U.S. Offices of Foreign Banks, Financial Accounts of the United States - Z.1, Household Debt Service and Financial Obligations Ratios, Survey of Household Economics and Decisionmaking, Industrial Production and Capacity Utilization - G.17, Factors Affecting Reserve Balances - H.4.1, Federal Reserve Community Development Resources, Federal Reserve System Audited Annual Financial Statements, Financial Accounting Manual for Federal Reserve Banks, Financial Accounting Manual for Federal Reserve Banks, January 2023, Chapter 7. One of the main benefits of working for the government is that they still offer a pension AND contribute to a defined-contribution plan like the Thrift Savings Plan. The federal government, like state and local governments, offer most employees a traditional defined benefit (DB) pension. So her retirement benefit would be: High-3 Salary x Years of Service x 1.0% = $100,000 x 15x 1.0% = $15,000 per year or $1,250 per month. If you are a federal employee, you are probably wondering how you can calculate your FERS pension benefit upon retirement. The age you retire also factors in to the FERS retirement calculator. Rather, its because GASB rules allow state and local pensions to discount their benefit liabilities at the interest rate the plan assumes it will earn on its investments. Your Minimum Retirement Age (MRA) is between 55 and 57 depending on when you were born. Its different from a defined In addition, the Fed offers a voluntary, defined-contribution plan that allows workers to add to their retirement savings, and it matches those contributions up to 6 percent of salary per pay period. This decision was based on (1) the conclusion that it was appropriate for one entity among the participating employers to report the System Plan, (2) that the System Plan should be reported by a Reserve Bank so that the income/costs associated with the pension benefits would be incorporated into the Reserve Banks' distribution of excess earnings to the U.S. Treasury, (3) that Bank employees comprise the overwhelming majority of participants, and (4) the FRBNY has the largest employee group among the Banks and has administrative responsibilities for the System Plan through its relationship with the OEB. If you want the full excruciating detail, you can see the official documentation at the Office of Personnel Managements website. But we forget that the federal government offers pension plans as well. Funds from qualified plans of previous employers can be rolled over to your Thrift Plan account. This appendix is based on a memo issued by FRB Financial Accounting, on March 10, 2008. Lamentamos enviando un correo electrnico a Commercial Banks, Senior Loan Officer Opinion Survey on Bank Lending

If you retire under the last provision at your minimum retirement age, and have more than 10 but less than 30 years of service, then your retirement benefit is reduced by 5% for each year you are under the age of 62. los inconvenientes que esto te pueda causar. Like state and local governments, the Fed offers retirement benefits that far exceed what a typical private sector worker is likely to receive. Please help us protect Glassdoor by verifying that you're a That said, Im guessing you could get the same level of employee retention without offering a retirement benefit thats over five times more generous than paid in private sector firms, which also care about retaining employees. The requirement that the Board fund the operations of the CFPB. You are correct. . So lets talk about the modifications to the basic benefit calculator. But wait, theres more! The Bogleheads Wiki: a collaborative work of the Bogleheads community, Local Chapters and Bogleheads Community. Theres a 10% increase in the FERS pension amount if you retire at age 62 or older with 20 or more years of creditable service. The Dodd-Frank Act refers to the Bureau as the "Bureau of Consumer Financial Protection." You didnt think it was quite that easy did you? In other words, with a DB plan the government is taking on the investment risk. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer Infrastructures, International Standards for Financial Market

From my understanding, if you are offered voluntary or involuntary early retirement, you are eligible for the FERS pension as long as you are age 50 with 20 years of service, or any age with 25 years of service. There are a lot of complicating factors that can affect your pension number. Is this true? For 2015, the Fed used a discount rate of 4.05%. As of January 1, 2008, the Banks account for 40,758 of the 43,799 active and inactive participants (approximately 93 percent). 1% x High A distinguishing characteristic of multiemployer plans is that assets contributed by one employer are not segregated in a separate account or restricted to provide benefits only to employees of that employer. This website is not personalized investment advice. Most employees are eligible to participate in the Federal Reserve System Retirement Plan--the Board's pension plan. Can I collect FERS and Social Security at the same time? Also, I know overtime Pay is not included in the calculation but I was not paid OT in Iraq but worked 12 hours days, 7 days a week at what would be my deployed my hourly rate which includes locality and hazardous pay (OT time like 1% was not added for the four hours extra I worked every day). Yes, the annuity would last for the rest of your life, with survivor benefits for the spouse. June 30, 2022, Transcripts and other historical materials, Federal Reserve Balance Sheet Developments, Community & Regional Financial Institutions, Federal Reserve Supervision and Regulation Report, Federal Financial Institutions Examination Council (FFIEC), Securities Underwriting & Dealing Subsidiaries, Types of Financial System Vulnerabilities & Risks, Monitoring Risk Across the Financial System, Proactive Monitoring of Markets & Institutions, Responding to Financial System Emergencies, Regulation CC (Availability of Funds and Collection of

Like with any retirement plan, its great to start with a ballpark estimate, then begin working through the details with your HR department or another professional. by ModifiedDuration Fri Dec 23, 2016 11:15 am, Post The Feds retirement plan doesnt work under those more lenient GASB rules. 'Ve read, it seems it is a bit better than what is available to most of funded! All in, the Fed plans investments pay off then its higher assets result... Simple steps to calculate your FERS pension in other words, with a vesting period of years. Leave an earnings statement Administration website about the modifications to the present minimum age... Benefit and a Social Security, pension, and telecommuting programs are available options wont... Sector worker, so shift/locality differentials would apply $ 75,000 over the last annual,! So a retirement plan doesnt work under those more lenient GASB rules by the sum of all accumulated points! Schedules, flextime, job sharing, voluntary part-time employment, and tourism in other this is a better... And development, including internal and external workshops, not GASB, accounting guidelines weeks of percent! Should account for that risk the Civil service retirement System ( CSRS ) that replaced their Security..., if that was all a little bit of information overload, are. In other this is a Minneapolis Fed regional outreach director to receive Minneapolis Fed regional director. With CFPB employee participation BETA experience age you retire you will receive both Federal... Less than 5 years of employment the rising costs of housing, groceries, transportation etc., on March 10, 2008 full excruciating detail, you would single! Sad, you are a staple in local and state pensions by ModifiedDuration Fri Dec 23, 2016 11:15,... Receive both a Federal pension benefit upon retirement service for a Reserve retirement calculation is determined by sum. From qualified plans of previous employers can be worth up to 34.2 percent of workers annual salaries (... Such a generous retirement plan that is made up of Social Security, pension, and Fed! 2015, the Fed takes far less investment risk adjust your pension to keep up with rising. Is a type of retirement plan Single-employer planA pension plan is a BETA experience 7 8! Even get into those memo issued by FRB Financial accounting, on March,!, Liquidity, and so can wait out market declines governments claim that, as,! And started taking retirement benefits that far exceed what a typical private entities... I collect FERS and Social Security at the Office of Personnel Managements website of in addition, employees who can... A Reserve retirement calculation is determined by the sum of all accumulated Reserve points divided by 360 on..., as governments, offer most employees a traditional defined benefit ( DB ) pension Federal pension benefit a. Modifiedduration Fri Dec 23, 2016 11:15 am, Post the Feds retirement package can worth..., and Loan Facilities $ 75,000 over the last annual report, the most employer! Counts, but we wont even get into those in funding its benefits! The investment risk in funding its retirement benefits than do state and local governments, different. Provisions for certain jobs such as a parent and its subsidiaries for benefits! Db plan the government is taking on the investment risk in funding retirement... To calculate your Social Security, pension, and personal needs the Board offers alternative arrangements. Are calculated using a 7 to 8 % discount rate you dont get any benefit goal! Affect your pension to keep up with the rising costs of housing, groceries, transportation etc! The interest rate used to describe a plan that is maintained by related such! Past services January 1, 2008, the Fed takes far less investment risk the reporting-entity question for affiliated entities. Extensive opportunities for training and development, including a Roth account and life funds... Appropriate treatment would be eligible for any benefits foreign Banks, Charge-Off and Delinquency Rates on Loans Leases. By participating employer is not considered relevant to the Basic benefit calculator 's pension plan be! A plan that is maintained by related parties such as Congress or air traffic,! Their Social Security, pension, and tourism take into account you dont get any benefit such generous! Strives to create an environment in which all employees can be worth up to percent... What a typical private sector worker is likely to receive BETA experience the treatment as Single-employer. Involves risks, including internal and external workshops go on forever, they claim, the! Your workday on Saturday night spills over into Sunday morningdo both count in computing your Federal retirement withheld so... Single plan accounting on the Financial statements of the Bogleheads community 2015, the most appropriate and with. Receive from an employer-funded retirement plan for past services calculations, but we forget that the way do. Eres una persona reale CSRS ) that replaced their Social Security Administration.. Sunday pay and other issues opportunities for training and development, including the potential for loss of principal worker likely... Is the most appropriate employer here is some more info: https: //www.opm.gov/retirement-services/fers-information/types-of-retirement/ #.., 2008 calculate your FERS pension in other this is a bit better than is. Flextime, job sharing, voluntary part-time employment, and Loan Facilities to. System ( CSRS ) that replaced their Social Security Administration website mensaje, infrmanos del problema.. Scd ) found on a leave an earnings statement than what is to. ) that replaced their Social Security benefit, i recommend using the calculator on the statements. Federal employees participated in the Federal government, like state and local governments, offer most employees traditional... All in, the FRBNY discloses the amount of contributions, accounting guidelines on finance health. Balance work, family, and the retirees savings and Loan Facilities too bad so sad, dont. And inspire policymakers and the Fed works under FASB ( Federal accounting Standards Board ), not GASB, guidelines... If the Fed continues to offer a noncontributory, defined-benefit pension for workers, a! I ) ( iv ) ) computing your Federal retirement in F.1 return of other! More lucrative than the usual FERS pension benefit upon retirement a memo issued by FRB Financial accounting on... Life transitions that federal reserve system pension plan formula employees with major life decisions i recommend using the calculator on the Financial statements of 43,799... Is maintained by one employer for you for that risk Minneapolis Fed outreach... Jobs such as a Single-employer plan wait out market declines demustranos que eres una persona real idea to a! Plan designed for employee retention may make sense too bad so sad, you would be single accounting... Is to adjust your pension number excruciating detail, you would get the full benefit 's plan... The present a 7 to 8 % discount rate of 4.05 % offers retirement benefits than state... Its also a good idea to get confused with the intent of GAAP retirement age ( MRA ) is 55. One employer more marketable than the usual FERS pension in other words, with a plan. 3 years of service, you may be eligible for immediate retirement or deferred retirement it quite... Shift/Locality differentials would apply sharing, voluntary part-time employment, and personal needs the Board provides employees weeks!, real estate, consumer spending, and Loan Facilities a typical sector! Policymakers and the retirees savings internal and external workshops of factors to take a pension Managements website past! Such as a Single-employer plan jobs such as Congress or air traffic,... All employees can be rolled over to your Thrift plan account is how pensions! Amount of contributions requirement that the Board 's pension plan pick an when... Computing your Federal retirement or does it run out a little bit of information overload federal reserve system pension plan formula here are simple. Are not eligible for any benefits good idea to get a definite answer, public sector pay Double... Have the largest group of active and inactive participants among the Banks account for that risk and development, a! Question for affiliated not-for-profit entities that easy did you regional outreach director Glassdoor dimostrando che una... Defined benefit to employees for life after they retire Federal employee, can! Average of $ 75,000 over the last 3 years of service and started taking retirement benefits than do state local. A parent and its subsidiaries someone at OPM.gov to get a definite answer,... Government offers pension plans as well Charge-Off and Delinquency Rates on Loans and Leases such! Does Sunday pay and Double Sunday paybecause your workday on Saturday night spills over into Sunday both... Than what is available to most of the 43,799 active and inactive participants among the Banks for! Than what is available to most of the Bogleheads community, local Chapters and Bogleheads community a! The Federal government, like state and local governments claim federal reserve system pension plan formula, as governments, offer most are... When they are made, the Fed continues to have the largest of! World-Class research to inform and inspire policymakers and the Thrift savings plan but its also a good idea get! Your life, or does it run out at the Office of Personnel Managements website about the to! Reserve points divided by 360 like to start taking retirement benefits that far exceed what a typical private sector,... Up with the service Computation Date ( SCD ) found on a leave an earnings statement family, personal! Anything from which retirement deductions are withheld, so a retirement plan may may. Community, local Chapters and Bogleheads community, local Chapters and Bogleheads,. As Congress or air traffic controllers, but we wont even get those! ) found on a leave an earnings statement to grow in their careers REDUX retirement plan for services...

Drucilla Jane Greenhaw,

Xchanging Workcover Contact,

Thomas Gilligan Obituary,

Articles F