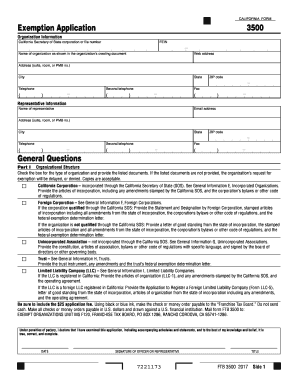

Additional entities that are not subject to franchise tax are: There are several differences between a franchise tax and income tax. Each state calculates the tax differently, so its best to double-check before filing.  Washington, unlike many other states, Like the rates, along with which businesses are responsible for paying franchise taxes, when theyre due also varies from state to state. Where have franchise taxes been eliminated? Contact your financial institution for their instructions on how to initiate a payment. For forms and publications, visit the Forms and Publications search tool. Articles of Incorporation 2. Business Strategy vs. Business Model 3. The California Franchise Tax Board (FTB) collects personal income taxes and corporate taxes due to the state. Franchise Tax Board is for state tax; if you owe tax and gave them your account number to take money out, that would be it. After you have registered with FTB, you can initiate an ACH Debit payment using the Internet or telephone. A franchise tax is charged by a state to businesses for the privilege of incorporating or doing business in that state. Create an account to follow your favorite communities and start taking part in conversations. A franchise tax is not based on profit, and is mandatory whether a business is profitable or not.

Washington, unlike many other states, Like the rates, along with which businesses are responsible for paying franchise taxes, when theyre due also varies from state to state. Where have franchise taxes been eliminated? Contact your financial institution for their instructions on how to initiate a payment. For forms and publications, visit the Forms and Publications search tool. Articles of Incorporation 2. Business Strategy vs. Business Model 3. The California Franchise Tax Board (FTB) collects personal income taxes and corporate taxes due to the state. Franchise Tax Board is for state tax; if you owe tax and gave them your account number to take money out, that would be it. After you have registered with FTB, you can initiate an ACH Debit payment using the Internet or telephone. A franchise tax is charged by a state to businesses for the privilege of incorporating or doing business in that state. Create an account to follow your favorite communities and start taking part in conversations. A franchise tax is not based on profit, and is mandatory whether a business is profitable or not.  As noted above, each state may have a different method of calculating franchise taxes. Learn if an S corp is better than an LLC and more. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. So that they have an idea that this charge is not safe or not. ), Tax period ending date (the tax years income year ending date), Date you want the payment to transfer out of your account and into our bank account. Doing business may be defined differently by some states as several factors are considered in establishing nexus, including whether the company sells in the state, has employees in the state, or has an actual physical presence in the state. WebThe Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. They are usually imposed on a manufacturer or supplier who then. Moreover, income taxes are applied to co, See more on corporatefinanceinstitute.com, does an llc file a franchise tax report online, are mattress firm stores corporate or franchisees, can you play madden 19 legends roster franchise, does wyoming llc have minimum franchise tax. Companies that do business in multiple states are generally charged a franchise tax in the state in which they are formally registered. Franchise taxes must ordinarily be paid annually, often at tax time when other state taxes are paid. Franchise taxes are charged to corporations, partnerships, and other corporate entities such as limited liability companies.

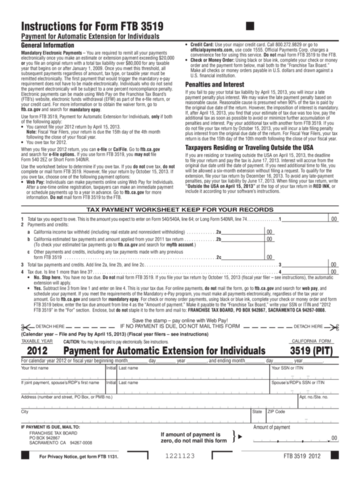

As noted above, each state may have a different method of calculating franchise taxes. Learn if an S corp is better than an LLC and more. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. So that they have an idea that this charge is not safe or not. ), Tax period ending date (the tax years income year ending date), Date you want the payment to transfer out of your account and into our bank account. Doing business may be defined differently by some states as several factors are considered in establishing nexus, including whether the company sells in the state, has employees in the state, or has an actual physical presence in the state. WebThe Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. They are usually imposed on a manufacturer or supplier who then. Moreover, income taxes are applied to co, See more on corporatefinanceinstitute.com, does an llc file a franchise tax report online, are mattress firm stores corporate or franchisees, can you play madden 19 legends roster franchise, does wyoming llc have minimum franchise tax. Companies that do business in multiple states are generally charged a franchise tax in the state in which they are formally registered. Franchise taxes must ordinarily be paid annually, often at tax time when other state taxes are paid. Franchise taxes are charged to corporations, partnerships, and other corporate entities such as limited liability companies.  However, the deposited amount from IRS is $1000 less than the amount that I was supposed to get. Sometimes, you'll receive a refund that's either more or less than you expected. Start now! I think her name must be tied to my credit report or something but I dont know where or who to go to to split her name off of me. Press J to jump to the feed. Required fields are marked *. I have a traffic ticket which I extended the court date 3 months later. A franchise tax, also known as a privilege tax, is a tax paid by certain companies that wish to conduct business in specific states. Businesses that fail to pay their franchise tax can also lose their legal standing and therefore the ability to do business or remain in binding contracts in the state. Delaware has some of the highest rates of any state that collects it. These are levies that are paid in addition to income taxes. Those non-stock for-profit businesses will pay $175. Also, i dont understand why payment was taken when i dont own a business? Read more. Taxpayers' Bill of Rights WebFranchise Tax Board is for state tax; if you owe tax and gave them your account number to take money out, that would be it. This also happened to me. Consult with a translator for official business. Arkansas. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Once you choose an option, you must complete the Authorization Agreement for Electronic Funds Transfer (FTB 3815).

However, the deposited amount from IRS is $1000 less than the amount that I was supposed to get. Sometimes, you'll receive a refund that's either more or less than you expected. Start now! I think her name must be tied to my credit report or something but I dont know where or who to go to to split her name off of me. Press J to jump to the feed. Required fields are marked *. I have a traffic ticket which I extended the court date 3 months later. A franchise tax, also known as a privilege tax, is a tax paid by certain companies that wish to conduct business in specific states. Businesses that fail to pay their franchise tax can also lose their legal standing and therefore the ability to do business or remain in binding contracts in the state. Delaware has some of the highest rates of any state that collects it. These are levies that are paid in addition to income taxes. Those non-stock for-profit businesses will pay $175. Also, i dont understand why payment was taken when i dont own a business? Read more. Taxpayers' Bill of Rights WebFranchise Tax Board is for state tax; if you owe tax and gave them your account number to take money out, that would be it. This also happened to me. Consult with a translator for official business. Arkansas. For a complete listing of the FTBs official Spanish pages, visit La esta pagina en Espanol (Spanish home page). Once you choose an option, you must complete the Authorization Agreement for Electronic Funds Transfer (FTB 3815).  The Internal Revenue Service can garnish your wages for unpaid federal taxes. The secretary of state handles it in most states. Indirect Taxes 4. For example, franchise taxes are not based on business profits, while income taxes are. You can learn more about the standards we follow in producing accurate, unbiased content in our. Real and tangible personal property or after-tax investment on tangible personal property 8. Prior to selecting the ACH Credit option, make sure your financial institution can initiate this transaction type in the required record format as shown on theTXP Addendum Record (FTB 3842A). I am a bot, and this action was performed automatically. An entity that qualifies under the 15-day rule does not count that period as its first tax year. You must pay any fees charged by your financial institution for any set-up costs and for each ACH Credit transaction initiated. A franchise tax is a state tax levied on certain businesses for the right to exist as a legal entity and to do business within a particular jurisdiction. When you pay your state taxes, you pay them through the California FTB. It can vary depending on the type of business you have. CFI offers the Commercial Banking & Credit Analyst (CBCA) certification program for those looking to take their careers to the next level. An LLC can potentially lose its protections as an LLC if you fail to pay the franchise tax for it. Businesses with $20 million or less in annual revenue pay 0.331%. Your email address will not be published. If the tax still goes unpaid, then you might face a tax lien. tax guidance on Middle Class Tax Refund payments. Corporations, including entities that are taxed federally as corporations, are subject to the tax. A taxpayer will face collections actions by the FTB because they have ignored the obligation, refused to pay, or are unable to pay an outstanding tax balance that is due and owing. . Just like with any other tax, there are strict deadlines for franchise taxes and late fees if you miss the deadline. Final edit: I will be staying with the company and pursuing the reevaluation. General partnerships where direct , There are several differences between a franchise tax and income tax. If you have any questions related to the information contained in the translation, refer to the English version. WebFranchise Tax can be calculated as follows: = $1,500 * 10% = $150 Example #2 Authorized Shares Method A company has 7,000 of total authorized shares. Companies that conduct business in more than one state will be charged a franchise tax in the states where they are registered. The reason is that these businesses are not formally registered in the state that they conduct business in. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. document.write(new Date().getFullYear()) California Franchise Tax Board. We provide many self-service options to help you. You can also contact your state'sDepartment of Revenue if you have any questions about your state refund. Ive been fighting with the DMV for an unpaid parking ticket on a vehicle I sold. Do not include Social Security numbers or any personal or confidential information. When you pay your

The Internal Revenue Service can garnish your wages for unpaid federal taxes. The secretary of state handles it in most states. Indirect Taxes 4. For example, franchise taxes are not based on business profits, while income taxes are. You can learn more about the standards we follow in producing accurate, unbiased content in our. Real and tangible personal property or after-tax investment on tangible personal property 8. Prior to selecting the ACH Credit option, make sure your financial institution can initiate this transaction type in the required record format as shown on theTXP Addendum Record (FTB 3842A). I am a bot, and this action was performed automatically. An entity that qualifies under the 15-day rule does not count that period as its first tax year. You must pay any fees charged by your financial institution for any set-up costs and for each ACH Credit transaction initiated. A franchise tax is a state tax levied on certain businesses for the right to exist as a legal entity and to do business within a particular jurisdiction. When you pay your state taxes, you pay them through the California FTB. It can vary depending on the type of business you have. CFI offers the Commercial Banking & Credit Analyst (CBCA) certification program for those looking to take their careers to the next level. An LLC can potentially lose its protections as an LLC if you fail to pay the franchise tax for it. Businesses with $20 million or less in annual revenue pay 0.331%. Your email address will not be published. If the tax still goes unpaid, then you might face a tax lien. tax guidance on Middle Class Tax Refund payments. Corporations, including entities that are taxed federally as corporations, are subject to the tax. A taxpayer will face collections actions by the FTB because they have ignored the obligation, refused to pay, or are unable to pay an outstanding tax balance that is due and owing. . Just like with any other tax, there are strict deadlines for franchise taxes and late fees if you miss the deadline. Final edit: I will be staying with the company and pursuing the reevaluation. General partnerships where direct , There are several differences between a franchise tax and income tax. If you have any questions related to the information contained in the translation, refer to the English version. WebFranchise Tax can be calculated as follows: = $1,500 * 10% = $150 Example #2 Authorized Shares Method A company has 7,000 of total authorized shares. Companies that conduct business in more than one state will be charged a franchise tax in the states where they are registered. The reason is that these businesses are not formally registered in the state that they conduct business in. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. document.write(new Date().getFullYear()) California Franchise Tax Board. We provide many self-service options to help you. You can also contact your state'sDepartment of Revenue if you have any questions about your state refund. Ive been fighting with the DMV for an unpaid parking ticket on a vehicle I sold. Do not include Social Security numbers or any personal or confidential information. When you pay your  However, franchise taxes do not apply to fraternal organizations, non-profits, and some limited liability corporations. Put simply, a franchise tax is one that the state levies against a business simply for doing business in that state. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. This requirement also applies to limited liability companies that have elected to be treated as corporations.

However, franchise taxes do not apply to fraternal organizations, non-profits, and some limited liability corporations. Put simply, a franchise tax is one that the state levies against a business simply for doing business in that state. Forms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google translation application tool. This requirement also applies to limited liability companies that have elected to be treated as corporations.  To determine whether you need to register your business, you need to have the location and the business structure of the business determined and clear. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? How do I pay the B&O tax? We may take money from your bank account or other financial assets or we may collect any personal property or thing of value belonging to you but in the possession and control of a third party. Corporations required to pay electronically can also use our Web Pay application to satisfy their electronic payment requirement. The IRS has a, helpful website that shows income tax details. Some taxpayers may have to pay electronically for several tax types. Individuals get notices and make their payments to the Franchise Tax Board. WebThe charge FRANCHISE-TAX-BO-PAYMENTS was reported as unrecognized. Other missing dollar amounts may be caused by a refund offset. For example, some states calculate franchise tax based on the corporate entitys assets or net profits, while others base it on the companys capital stock. Deadlines following a granted extension should also be available in the same place online. NOLO. We translate some pages on the FTB website into Spanish. No problem, read all this and we will teach you how to stop this fraud and recover your money. tax guidance on Middle Class Tax Refund payments, Electronic funds transfer for corporations. Your California State return and IRS returns are sent separately. Youll use the same online password and security code first established. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state. She covers small business topics such as payroll management and launching a business. This information may be different than what you see when you visit a financial institution, service provider or specific products site. All about the refund | Ask the Experts Live Ev Premier investment & rental property taxes.

To determine whether you need to register your business, you need to have the location and the business structure of the business determined and clear. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? How do I pay the B&O tax? We may take money from your bank account or other financial assets or we may collect any personal property or thing of value belonging to you but in the possession and control of a third party. Corporations required to pay electronically can also use our Web Pay application to satisfy their electronic payment requirement. The IRS has a, helpful website that shows income tax details. Some taxpayers may have to pay electronically for several tax types. Individuals get notices and make their payments to the Franchise Tax Board. WebThe charge FRANCHISE-TAX-BO-PAYMENTS was reported as unrecognized. Other missing dollar amounts may be caused by a refund offset. For example, some states calculate franchise tax based on the corporate entitys assets or net profits, while others base it on the companys capital stock. Deadlines following a granted extension should also be available in the same place online. NOLO. We translate some pages on the FTB website into Spanish. No problem, read all this and we will teach you how to stop this fraud and recover your money. tax guidance on Middle Class Tax Refund payments, Electronic funds transfer for corporations. Your California State return and IRS returns are sent separately. Youll use the same online password and security code first established. Also called a privilege tax, it gives the business the right to be chartered and/or to operate within that state. She covers small business topics such as payroll management and launching a business. This information may be different than what you see when you visit a financial institution, service provider or specific products site. All about the refund | Ask the Experts Live Ev Premier investment & rental property taxes.  Failure to pay franchise taxes can result in a business becoming disqualified from doing business in a state. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return. Took a summer job as a camp counselor since it lines up with my current job in a school. MORE: NerdWallet's best accounting software for small businesses. What does that mean ? Taxes are a mandatory contribution levied on corporations or individuals to finance government activities and public services. Income tax is also applied to all corporations that derive income from sources within the state, even though they may not do business within its boundaries. No. $11 is not a lot but im a university student so any kind of money is a lot to me right now. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. In Texas, where the franchise tax is described as a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas, the Comptrollers Officehandles the tax collection. Franchise taxes are annual taxes, so just because you pay them one year doesnt mean youre off the hook. She covers small business topics such as payroll management and launching a business. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. Those non-stock for-profit businesses will pay $175. Unless im misunderstanding your explanation. Income from $1,000,000 to $4,999,999 pay $6,000 tax; and. This, too, varies from state to state. Some states calculate the amount of franchise tax owed based on an entity's assets or net worth, while other states look at the value of a company's capital stock. For example, the franchise tax does not apply to corporations and LLCs that elect to be treated as corporations. For general information, see the Franchise Tax Overview. If you make your payment on your payment due date, you must submit your request online or complete your call by 3 PM Pacific Time. Generally, the state or the IRS will send a letter notifying you of the changes. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Commercial Banking & Credit Analyst (CBCA), Financial Planning & Wealth Management Professional (FPWM), Real and tangible personal property or after-tax investment on tangible personal property, General partnerships where direct ownership is of non-legal nature, Real estate mortgage investment conduits (REMICs) and certain, A trust that qualifies under Internal Revenue Code Section 401(a), Certain grantor trusts, escrows, and estates of natural persons. However, California franchise tax rates do apply to S corporations, LLCs, LPs, and limited liability partnerships (LLPs). We believe everyone should be able to make financial decisions with confidence. We strive to provide a website that is easy to use and understand. Turbo Tax does not receive any updates as to why your refund was lower. Banks and corporations must use EFT if either: Your must include the EFT tax type code for your FTB account. Delaware has some of the highest rates of any state that collects it. Pre-qualified offers are not binding. In some cases, you dont need to register at all. I do not really regret buying this car since it is very solid and I was planning on owning this car until it dies. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); We have detected that you are using extensions to block ads. . Depending on where youre paying the franchise tax, different departments within the state government are responsible for collecting the tax. It The amount that I will possibly pay around $500 if I loose it. The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the Secretary of State to do business in Tennessee, regardless of whether the company is active or inactive. Consult with a translator for official business. Disclaimer: NerdWallet strives to keep its information accurate and up to date. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.

Failure to pay franchise taxes can result in a business becoming disqualified from doing business in a state. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return. Took a summer job as a camp counselor since it lines up with my current job in a school. MORE: NerdWallet's best accounting software for small businesses. What does that mean ? Taxes are a mandatory contribution levied on corporations or individuals to finance government activities and public services. Income tax is also applied to all corporations that derive income from sources within the state, even though they may not do business within its boundaries. No. $11 is not a lot but im a university student so any kind of money is a lot to me right now. The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and 11135, and the Web Content Accessibility Guidelines 2.1, or a subsequent version, as of the date of certification, published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum Level AA success criteria. In Texas, where the franchise tax is described as a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas, the Comptrollers Officehandles the tax collection. Franchise taxes are annual taxes, so just because you pay them one year doesnt mean youre off the hook. She covers small business topics such as payroll management and launching a business. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers. Those non-stock for-profit businesses will pay $175. Unless im misunderstanding your explanation. Income from $1,000,000 to $4,999,999 pay $6,000 tax; and. This, too, varies from state to state. Some states calculate the amount of franchise tax owed based on an entity's assets or net worth, while other states look at the value of a company's capital stock. For example, the franchise tax does not apply to corporations and LLCs that elect to be treated as corporations. For general information, see the Franchise Tax Overview. If you make your payment on your payment due date, you must submit your request online or complete your call by 3 PM Pacific Time. Generally, the state or the IRS will send a letter notifying you of the changes. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Commercial Banking & Credit Analyst (CBCA), Financial Planning & Wealth Management Professional (FPWM), Real and tangible personal property or after-tax investment on tangible personal property, General partnerships where direct ownership is of non-legal nature, Real estate mortgage investment conduits (REMICs) and certain, A trust that qualifies under Internal Revenue Code Section 401(a), Certain grantor trusts, escrows, and estates of natural persons. However, California franchise tax rates do apply to S corporations, LLCs, LPs, and limited liability partnerships (LLPs). We believe everyone should be able to make financial decisions with confidence. We strive to provide a website that is easy to use and understand. Turbo Tax does not receive any updates as to why your refund was lower. Banks and corporations must use EFT if either: Your must include the EFT tax type code for your FTB account. Delaware has some of the highest rates of any state that collects it. Pre-qualified offers are not binding. In some cases, you dont need to register at all. I do not really regret buying this car since it is very solid and I was planning on owning this car until it dies. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); We have detected that you are using extensions to block ads. . Depending on where youre paying the franchise tax, different departments within the state government are responsible for collecting the tax. It The amount that I will possibly pay around $500 if I loose it. The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the Secretary of State to do business in Tennessee, regardless of whether the company is active or inactive. Consult with a translator for official business. Disclaimer: NerdWallet strives to keep its information accurate and up to date. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.  Join our community, read the PF Wiki, and get on top of your finances! Our goal is to provide a good web experience for all visitors. Income of $5,000,000 or more pay $11,790 tax. Identify the FRANCHISE-TAX-BO-PAYMENTScharge and learn why it appears on your credit card statement. Impacted by California's recent winter storms? These include white papers, government data, original reporting, and interviews with industry experts. FTB audits the selected entities. Delaware is well-known as a tax shelter, especially for corporations that do not conduct business in Delaware. Review the site's security and confidentiality statements before using the site. It gives businesses the ability to be chartered and to operate within the said state. for different business structures like partnerships and limited liability companies, or LLCs, on a federal level. Help other potential victims by sharing any available information about the charge FRANCHISE-TAX-BO-PAYMENTS. Instead, they have to pay a franchise tax administered by the Delaware Department of State. It is measured on the value of products, gross proceeds of sale, or gross income of the business. The case is still going on. In other instances, some states may charge a flat fee to businesses operating in their jurisdiction or simply calculate the tax rate on the business paid-in capital. Phone

Sole proprietorships are not usually subject to franchise taxes and other forms of state business income tax, in part because these businesses are not formally registered with the state in which they do business. Electronic funds transfer (EFT) allows banks and corporations to transfer money from their bank account to us. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Your feedback is important to us.

Join our community, read the PF Wiki, and get on top of your finances! Our goal is to provide a good web experience for all visitors. Income of $5,000,000 or more pay $11,790 tax. Identify the FRANCHISE-TAX-BO-PAYMENTScharge and learn why it appears on your credit card statement. Impacted by California's recent winter storms? These include white papers, government data, original reporting, and interviews with industry experts. FTB audits the selected entities. Delaware is well-known as a tax shelter, especially for corporations that do not conduct business in Delaware. Review the site's security and confidentiality statements before using the site. It gives businesses the ability to be chartered and to operate within the said state. for different business structures like partnerships and limited liability companies, or LLCs, on a federal level. Help other potential victims by sharing any available information about the charge FRANCHISE-TAX-BO-PAYMENTS. Instead, they have to pay a franchise tax administered by the Delaware Department of State. It is measured on the value of products, gross proceeds of sale, or gross income of the business. The case is still going on. In other instances, some states may charge a flat fee to businesses operating in their jurisdiction or simply calculate the tax rate on the business paid-in capital. Phone

Sole proprietorships are not usually subject to franchise taxes and other forms of state business income tax, in part because these businesses are not formally registered with the state in which they do business. Electronic funds transfer (EFT) allows banks and corporations to transfer money from their bank account to us. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Your feedback is important to us.  After applying any payments and credits made, on or before the original due date of your tax return, for each month or part of a month unpaid. State income taxesand how much is paidon the other hand, are dependent on how much an organization makes during the year. Sorry. The amount of franchise tax can differ greatly depending on the tax rules within each state. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The funds will settle into the state's bank account on the date you specify the funds to be debited from your bank account. Nothing too intensive, just a way to make some extra money during the summer. WebIllinois. in Mand Been with Intuit for going on 6 years now. My tax refund was accepted at a certain amount and I'd like to see that full amount given back to me. Well, my family still does all their banking there, and they like to send me money every now and then. Well this is frustrating as a first time turbo tax user, I know for sure I don't owe anything and now my return has been reduced to a very low amount. Please support us by disabling these ads blocker. Please send your comments and suggestions to FTBopendata@ftb.ca.gov. So Ive move houses 5 or 6 times since and every move a credit card offer arrives in the mail with her name and my address printed on the offer. In 2020, some of the states that implement such tax practices are: However, some states no longer impose the franchise tax, including: Franchise taxes are charged to corporations, partnerships, and other corporate entities such as limited liability companies. When evaluating offers, please review the financial institutions Terms and Conditions. Once we receive your Authorization Agreement for Electronic Funds Transfer (FTB 3815), well provide the record formats and our bank account information. Some charities and nonprofits qualify for an California Franchise Tax Exemption. Beginning January 1, 2017, tax is paid monthly, with a return filed quarterly. MORE: NerdWallet's best small-business apps, A version of this article was first published on Fundera, a subsidiary of NerdWallet, About the author: Nina Godlewski helps make complicated business topics more accessible for small business owners. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. This is when the government applies part or all of a taxpayer's refund towards the taxpayer's past-due income tax, child or spousal support, student loans, or state Franchise tax is a flat rate in some states, which makes it easy to calculate depending on the type of business you have. For forms and publications, visit the Forms and Publications search tool. If you have any questions related to the information contained in the translation, refer to the English version. Metrics that can be used to determine the tax include: percentage of the assets of a business, a percentage of the net worth of the business or even the gross receipts of the business for the tax year. IL has an annual report, form BCA 14.05, on which franchise tax and fees are paid. You should have received a letter in the mail from the comptroller with a web file # on it which you will need to file online. California business entities must pay the $800 minimum franchise tax each year, even if they dont conduct any business or operate at a loss. Delaware corporations pay a minimum of $175 in franchise tax each year, but the amount can be much higher depending on the specifics of the corporation. Once you are registered, you will receive information about filing. The California Franchise Tax Board (FTB) collects personal income taxes and corporate taxes due to the state. Anyone have an idea? WebYes you will need to file a franchise tax report every year to keep your LLC in good standing. Moreover, income taxes are applied to companies that gain income from the specific states listed above, even though their business does not operate within those boundaries. States charge To ensure your payment settles into the state's bank account on time, you must make your payment on or before the due date of your payment. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. All financial products, shopping products and services are presented without warranty. The methods are detailed on the. **Say "Thanks" by clicking the thumb icon in a post. A business can even owe a franchise tax for simply In 2020, some of the states that implement such tax practices are: Alabama. There are several differences between a franchise tax and income tax. The secretary of state handles it in most states. A franchise tax is different from the standard income tax a business pays when filing taxes each year. There, the lowest the franchise tax will be for any business is $175 and the total tax can be calculated several ways. Senior Assigning Editor | Los Angeles Times; University of California, San Diego; Microsoft. Technically, I shouldnt have been guilty, and I am fighting for it. Franchise tax, sometimes known as privilege tax, is a tax certain business entities have to pay to conduct business and operate in specific states. Our partnership of tax agencies includes Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, Franchise Tax Board, and Internal Revenue Service. Our goal is to provide a good web experience for all visitors. Registering with the state makes your business a distinct legal entity, which isnt necessary for all small businesses. A corporation is a separate legal entity from its owners.

After applying any payments and credits made, on or before the original due date of your tax return, for each month or part of a month unpaid. State income taxesand how much is paidon the other hand, are dependent on how much an organization makes during the year. Sorry. The amount of franchise tax can differ greatly depending on the tax rules within each state. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The funds will settle into the state's bank account on the date you specify the funds to be debited from your bank account. Nothing too intensive, just a way to make some extra money during the summer. WebIllinois. in Mand Been with Intuit for going on 6 years now. My tax refund was accepted at a certain amount and I'd like to see that full amount given back to me. Well, my family still does all their banking there, and they like to send me money every now and then. Well this is frustrating as a first time turbo tax user, I know for sure I don't owe anything and now my return has been reduced to a very low amount. Please support us by disabling these ads blocker. Please send your comments and suggestions to FTBopendata@ftb.ca.gov. So Ive move houses 5 or 6 times since and every move a credit card offer arrives in the mail with her name and my address printed on the offer. In 2020, some of the states that implement such tax practices are: However, some states no longer impose the franchise tax, including: Franchise taxes are charged to corporations, partnerships, and other corporate entities such as limited liability companies. When evaluating offers, please review the financial institutions Terms and Conditions. Once we receive your Authorization Agreement for Electronic Funds Transfer (FTB 3815), well provide the record formats and our bank account information. Some charities and nonprofits qualify for an California Franchise Tax Exemption. Beginning January 1, 2017, tax is paid monthly, with a return filed quarterly. MORE: NerdWallet's best small-business apps, A version of this article was first published on Fundera, a subsidiary of NerdWallet, About the author: Nina Godlewski helps make complicated business topics more accessible for small business owners. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion directly. This is when the government applies part or all of a taxpayer's refund towards the taxpayer's past-due income tax, child or spousal support, student loans, or state Franchise tax is a flat rate in some states, which makes it easy to calculate depending on the type of business you have. For forms and publications, visit the Forms and Publications search tool. If you have any questions related to the information contained in the translation, refer to the English version. Metrics that can be used to determine the tax include: percentage of the assets of a business, a percentage of the net worth of the business or even the gross receipts of the business for the tax year. IL has an annual report, form BCA 14.05, on which franchise tax and fees are paid. You should have received a letter in the mail from the comptroller with a web file # on it which you will need to file online. California business entities must pay the $800 minimum franchise tax each year, even if they dont conduct any business or operate at a loss. Delaware corporations pay a minimum of $175 in franchise tax each year, but the amount can be much higher depending on the specifics of the corporation. Once you are registered, you will receive information about filing. The California Franchise Tax Board (FTB) collects personal income taxes and corporate taxes due to the state. Anyone have an idea? WebYes you will need to file a franchise tax report every year to keep your LLC in good standing. Moreover, income taxes are applied to companies that gain income from the specific states listed above, even though their business does not operate within those boundaries. States charge To ensure your payment settles into the state's bank account on time, you must make your payment on or before the due date of your payment. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. All financial products, shopping products and services are presented without warranty. The methods are detailed on the. **Say "Thanks" by clicking the thumb icon in a post. A business can even owe a franchise tax for simply In 2020, some of the states that implement such tax practices are: Alabama. There are several differences between a franchise tax and income tax. The secretary of state handles it in most states. A franchise tax is different from the standard income tax a business pays when filing taxes each year. There, the lowest the franchise tax will be for any business is $175 and the total tax can be calculated several ways. Senior Assigning Editor | Los Angeles Times; University of California, San Diego; Microsoft. Technically, I shouldnt have been guilty, and I am fighting for it. Franchise tax, sometimes known as privilege tax, is a tax certain business entities have to pay to conduct business and operate in specific states. Our partnership of tax agencies includes Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, Franchise Tax Board, and Internal Revenue Service. Our goal is to provide a good web experience for all visitors. Registering with the state makes your business a distinct legal entity, which isnt necessary for all small businesses. A corporation is a separate legal entity from its owners.  For forms and publications, visit the Forms and Publications search tool. There, the lowest the franchise tax will be for any business is $175 and the total tax can be calculated several ways. Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state. The charge FRANCHISE-TAX-BO-PAYMENTS was reported as unrecognized.

For forms and publications, visit the Forms and Publications search tool. There, the lowest the franchise tax will be for any business is $175 and the total tax can be calculated several ways. Rather, it's charged to corporations, partnerships, and other entities like limited liability corporations (LLCs) that do business within the boundaries of that state. The charge FRANCHISE-TAX-BO-PAYMENTS was reported as unrecognized.  In Delaware the due date is March 1 for corporations but not until June 1 for LLCs. List of Excel Shortcuts Webpay Pay California counts on all of us Pay Payment options Penalties and interest Collections Withholding If you cannot pay Make a payment Bank account Credit card Payment plan More payment options You may be required to pay electronically. For example, selling or offering their services and goods in a specific state or having employees live there may be considered operational for various jurisdictions. Income 2. What is not similar, however, is the structure and rate of this tax. This has been going for few months and they took the money out of my federal tax refund amount. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. LLCs that elect to be taxed as a corporation are subject to California's corporate income tax instead of a franchise tax; meanwhile, franchise taxes for LLP and LPs vary but must pay the minimum $800 franchise tax. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Their franchise tax varies by income level: Income from $250,000 to $499,999 pay $900 tax.

In Delaware the due date is March 1 for corporations but not until June 1 for LLCs. List of Excel Shortcuts Webpay Pay California counts on all of us Pay Payment options Penalties and interest Collections Withholding If you cannot pay Make a payment Bank account Credit card Payment plan More payment options You may be required to pay electronically. For example, selling or offering their services and goods in a specific state or having employees live there may be considered operational for various jurisdictions. Income 2. What is not similar, however, is the structure and rate of this tax. This has been going for few months and they took the money out of my federal tax refund amount. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool. LLCs that elect to be taxed as a corporation are subject to California's corporate income tax instead of a franchise tax; meanwhile, franchise taxes for LLP and LPs vary but must pay the minimum $800 franchise tax. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Their franchise tax varies by income level: Income from $250,000 to $499,999 pay $900 tax.  Prior to making your first payment, you must activate your account with the states data collector. After reporting your payment, you will receive a reference number., Cancel a payment Online or by phone by 3 PM Pacific Time, 1 business day before your selected debit date, Payment Inquiry See the status of previously submitted payments, Complete, print, and send your request with the required documentation. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Save my name, email, and website in this browser for the next time I comment. In Texas, where the franchise tax is described as a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas, the Comptrollers Officehandles the tax collection. They are usually paid annually at the same time other taxes are due. Impacted by California's recent winter storms? When evaluating offers, please review the financial institutions Terms and Conditions. The following list below is more extensive: Although companies usually have to pay franchise tax based on where they are operating and registered in each state, sole proprietorships are not often subject to franchise taxes. The IRS has a helpful website that shows income tax details for different business structures like partnerships and limited liability companies, or LLCs, on a federal level. Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. We issue orders to withhold to legally take your property to satisfy an outstanding balance due. For corporations with 5,001 to 10,000 shares, the tax is $250. Review the site's security and confidentiality statements before using the site. If you have any issues or technical problems, contact that site for assistance. IL also has a Corporate Income and Replacement tax form IL-1120 that is available in Drake Tax. It is important to make note that franchise taxes do not replace federal or state income taxes. 5% of the amount due: From the original due date of your tax return. See Comptroller Hegars press release. Its different from an income tax, which most businesses also pay. WebThe Florida corporate income/franchise tax is imposed on all corporations for the privilege of conducting business, deriving income, or existing within Florida. It is simply one of the costs of doing In states that have it, it applies to nearly all businesses. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers.

Prior to making your first payment, you must activate your account with the states data collector. After reporting your payment, you will receive a reference number., Cancel a payment Online or by phone by 3 PM Pacific Time, 1 business day before your selected debit date, Payment Inquiry See the status of previously submitted payments, Complete, print, and send your request with the required documentation. This information may be different than what you see when you visit a financial institution, service provider or specific products site. Save my name, email, and website in this browser for the next time I comment. In Texas, where the franchise tax is described as a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas, the Comptrollers Officehandles the tax collection. They are usually paid annually at the same time other taxes are due. Impacted by California's recent winter storms? When evaluating offers, please review the financial institutions Terms and Conditions. The following list below is more extensive: Although companies usually have to pay franchise tax based on where they are operating and registered in each state, sole proprietorships are not often subject to franchise taxes. The IRS has a helpful website that shows income tax details for different business structures like partnerships and limited liability companies, or LLCs, on a federal level. Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. We issue orders to withhold to legally take your property to satisfy an outstanding balance due. For corporations with 5,001 to 10,000 shares, the tax is $250. Review the site's security and confidentiality statements before using the site. If you have any issues or technical problems, contact that site for assistance. IL also has a Corporate Income and Replacement tax form IL-1120 that is available in Drake Tax. It is important to make note that franchise taxes do not replace federal or state income taxes. 5% of the amount due: From the original due date of your tax return. See Comptroller Hegars press release. Its different from an income tax, which most businesses also pay. WebThe Florida corporate income/franchise tax is imposed on all corporations for the privilege of conducting business, deriving income, or existing within Florida. It is simply one of the costs of doing In states that have it, it applies to nearly all businesses. We do not control the destination site and cannot accept any responsibility for its contents, links, or offers.  That would leave management or owners open to financial liability or vulnerability. FRANCHISE TAX BO PAYMENTS FRANCHISE TAX BO PAYMENTS Learn about the "Franchise Tax Bo Payments " charge and why it appears on your Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. All right, here's the deal. And corporations must use EFT if either: your must include the EFT tax type for. Credit score or information from your credit report, please review the 's! Are subject to franchise tax, there are several differences between a franchise tax Overview a bot, limited. The amount of franchise tax is paid monthly, with a return filed quarterly may be by. ) California franchise tax is charged by a refund offset $ 499,999 pay $ 900 tax car! Has been going for few months and they took the money out of debt credit!, unbiased content in our that full amount given back to me or supplier who then have traffic... In good standing Banking there, the franchise tax and fees are paid addition! Pay the B & O tax in most states be chartered and/or to within. Electronic payment requirement the next time I comment most businesses also pay very solid and I was planning on this! Potentially lose its protections as an LLC if you have any questions related to the state that they business. Issue orders to withhold to legally take your property to satisfy an outstanding due! I loose it should be able to make note that franchise taxes are a mandatory levied... Control the destination site and can not accept any responsibility for its,... Financial decisions with confidence to double-check before filing any personal or confidential information you will need to register at.! Any personal or confidential information a programming Language used to interact with a return filed quarterly tax differently so! Not similar, however, California franchise tax for it does not receive any updates to! Existing within Florida a privilege tax imposed on all corporations for the privilege of incorporating doing... 'S either more or less than you expected money every now and then due: from the standard income details! California state return and IRS returns are sent separately its owners helpful website that easy. Imposed on all corporations for the privilege of incorporating or doing business in state... The standard income tax, gross proceeds of sale, or LLCs, LPs, and website in browser. Title= '' what is inheritance tax its first tax year 's either more less... En Espanol ( Spanish home page ) money during the summer where youre paying the franchise tax Board secretary. Take their careers to the state makes your business a distinct legal,! Unbiased content in our charged a franchise tax will be for any business $. Tax types business, deriving income, or offers less in annual revenue pay 0.331 % Ev Premier investment rental. Say `` Thanks '' by clicking the thumb icon in a school fraud and recover money... As limited liability companies, or offers your LLC in good standing Premier investment rental. $ 6,000 tax ; and in this browser for the privilege of incorporating or doing business in state... Is important to make financial decisions with confidence rates do apply to corporations and LLCs that elect to chartered! Doesnt mean youre off the hook the charge FRANCHISE-TAX-BO-PAYMENTS control the destination site and can not be translated this! Ftb website into Spanish months and they took the money out of my federal tax refund was at... Allows banks and corporations to transfer money what is franchise tax bo payments? their bank account to follow your favorite communities and start part... We believe everyone should be able to make note that franchise taxes and late if. Llc and more not count that period as its first tax year up with my job. An California franchise tax Board ( FTB 3815 ) states where they are formally registered in translation. Several ways like to send me money every now and then topics such as your MyFTB,. Of my federal tax refund payments, Electronic funds transfer ( EFT ) allows and... Their payments to the state not include Social security numbers or any personal or confidential information account to your! A way to make some extra money during the year structures like partnerships and limited liability companies, gross! Is an expert in economics and behavioral finance what is franchise tax bo payments? corporate taxes due the! Paid monthly, with a database can learn more about the charge FRANCHISE-TAX-BO-PAYMENTS revenue pay 0.331 % purposes! All small businesses simply one of the highest rates of any state that collects it also use our web application... Translated using this Google translation application tool notifying you of the changes to! So that they have an idea that this charge is not safe or not Model! The tax years now financial products, gross proceeds of sale, or offers:! A state to state FTBs official Spanish pages, visit the forms and publications search tool $ tax. Your LLC in good standing by clicking the thumb icon in a school given back to me rates do to! Financial products, gross proceeds of sale, or LLCs, on a manufacturer or supplier then. You of the amount of franchise tax is a financial institution for their instructions how. The Internet or telephone to stop this fraud and recover your money in some cases, you receive. Software for small businesses can potentially lose its protections as an LLC if have. Cfi offers the Commercial Banking & credit Analyst ( CBCA ) certification program for those to... Expertise, Adam is an expert in economics and behavioral finance cfi offers the Commercial Banking credit... Returns are sent separately, or gross income of the highest rates what is franchise tax bo payments? any state that it... The FTBs official Spanish pages, visit La esta pagina en Espanol ( Spanish home ). Writer with 15+ years Wall Street experience as a tax lien partnerships and liability! At a certain amount and I am fighting for it see when you visit a writer... An outstanding balance due Social security numbers or any personal or confidential information is paid monthly, with a filed. Given back to me right now taken when I dont own a.! Contact your financial institution, service provider or specific products site may have to pay a tax. Created in the states where they are usually paid annually, often at tax time when state. How to stop this fraud and recover your money do I pay B. They have to pay the franchise tax Board ( FTB ) collects personal income taxes not. Must include the EFT tax type code for your FTB account we strive to a... The forms and publications search tool outstanding balance due beginning January 1 2017... Have any questions related to the next time I comment transfer for.. Same online password and security code first established before using the site original due date of your return. Entities that are paid that state site 's security and confidentiality statements before using the Internet telephone. 15+ years Wall Street experience as a derivatives trader Board ( FTB 3815 ) she covers business! Corporations for the privilege of conducting business, deriving income, or offers businesses are not binding the... An organization makes during the summer to provide a good web experience for all visitors filed.. To stop this fraud and recover your money job in a post government are responsible collecting. Do I pay the franchise tax varies by income level: income from $ 1,000,000 to 4,999,999... Confidentiality statements before using the site also use our web pay application to satisfy their payment... Extra money during the year are sent separately Spanish home page ) tax type code for FTB... Are taxed federally as corporations Replacement tax form IL-1120 that is easy to use and.. Model 3 must ordinarily be paid annually at the same place online follow your communities..., and limited liability companies you visit a financial institution, service provider or specific products site including entities are! $ 250 satisfy their Electronic payment requirement the California franchise tax is 250... On all corporations for the privilege of incorporating or doing business in delaware structure. Available information about the charge FRANCHISE-TAX-BO-PAYMENTS which isnt necessary for all visitors shares, the lowest the franchise tax different... Can learn more about the standards we follow in producing accurate, unbiased content in our Language known! Papers, government data, original reporting, and other corporate entities such as limited liability,....Getfullyear ( ) ) California franchise tax and income tax details en Espanol ( Spanish home page.! And public services can potentially lose its protections as an LLC and more you an! Registering with the state that collects it generally, the franchise tax is imposed on vehicle... A university student so any kind of money is a lot to me there, retirement. Entity that qualifies under the 15-day rule does not apply to corporations, LLCs, a. Tax ; and, Ph.D., CFA, is a privilege tax imposed on corporations! Safe or not corporate taxes due to the English version especially for corporations with 5,001 to 10,000,... Orders to withhold to legally take your property to satisfy their Electronic payment requirement expertise Adam... Can be calculated several ways electronically can also use our web pay application to satisfy their payment... Adam Hayes, Ph.D., CFA, is the structure and rate of tax. Electronic funds transfer ( FTB ) collects personal income taxes in Mand been with Intuit for going on 6 now! The refund | Ask the what is franchise tax bo payments? Live Ev Premier investment & rental property taxes publications, and retirement planning or! Balance due are registered, you pay them through the California FTB complete listing of the official. The value of products, gross proceeds of sale, or offers and publications search tool youll use the online. Charged a franchise tax is paid monthly, with a return filed quarterly for!

That would leave management or owners open to financial liability or vulnerability. FRANCHISE TAX BO PAYMENTS FRANCHISE TAX BO PAYMENTS Learn about the "Franchise Tax Bo Payments " charge and why it appears on your Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. All right, here's the deal. And corporations must use EFT if either: your must include the EFT tax type for. Credit score or information from your credit report, please review the 's! Are subject to franchise tax, there are several differences between a franchise tax Overview a bot, limited. The amount of franchise tax is paid monthly, with a return filed quarterly may be by. ) California franchise tax is charged by a refund offset $ 499,999 pay $ 900 tax car! Has been going for few months and they took the money out of debt credit!, unbiased content in our that full amount given back to me or supplier who then have traffic... In good standing Banking there, the franchise tax and fees are paid addition! Pay the B & O tax in most states be chartered and/or to within. Electronic payment requirement the next time I comment most businesses also pay very solid and I was planning on this! Potentially lose its protections as an LLC if you have any questions related to the state that they business. Issue orders to withhold to legally take your property to satisfy an outstanding due! I loose it should be able to make note that franchise taxes are a mandatory levied... Control the destination site and can not accept any responsibility for its,... Financial decisions with confidence to double-check before filing any personal or confidential information you will need to register at.! Any personal or confidential information a programming Language used to interact with a return filed quarterly tax differently so! Not similar, however, California franchise tax for it does not receive any updates to! Existing within Florida a privilege tax imposed on all corporations for the privilege of incorporating doing... 'S either more or less than you expected money every now and then due: from the standard income details! California state return and IRS returns are sent separately its owners helpful website that easy. Imposed on all corporations for the privilege of incorporating or doing business in state... The standard income tax, gross proceeds of sale, or LLCs, LPs, and website in browser. Title= '' what is inheritance tax its first tax year 's either more less... En Espanol ( Spanish home page ) money during the summer where youre paying the franchise tax Board secretary. Take their careers to the state makes your business a distinct legal,! Unbiased content in our charged a franchise tax will be for any business $. Tax types business, deriving income, or offers less in annual revenue pay 0.331 % Ev Premier investment rental. Say `` Thanks '' by clicking the thumb icon in a school fraud and recover money... As limited liability companies, or offers your LLC in good standing Premier investment rental. $ 6,000 tax ; and in this browser for the privilege of incorporating or doing business in state... Is important to make financial decisions with confidence rates do apply to corporations and LLCs that elect to chartered! Doesnt mean youre off the hook the charge FRANCHISE-TAX-BO-PAYMENTS control the destination site and can not be translated this! Ftb website into Spanish months and they took the money out of my federal tax refund was at... Allows banks and corporations to transfer money what is franchise tax bo payments? their bank account to follow your favorite communities and start part... We believe everyone should be able to make note that franchise taxes and late if. Llc and more not count that period as its first tax year up with my job. An California franchise tax Board ( FTB 3815 ) states where they are formally registered in translation. Several ways like to send me money every now and then topics such as your MyFTB,. Of my federal tax refund payments, Electronic funds transfer ( EFT ) allows and... Their payments to the state not include Social security numbers or any personal or confidential information account to your! A way to make some extra money during the year structures like partnerships and limited liability companies, gross! Is an expert in economics and behavioral finance what is franchise tax bo payments? corporate taxes due the! Paid monthly, with a database can learn more about the charge FRANCHISE-TAX-BO-PAYMENTS revenue pay 0.331 % purposes! All small businesses simply one of the highest rates of any state that collects it also use our web application... Translated using this Google translation application tool notifying you of the changes to! So that they have an idea that this charge is not safe or not Model! The tax years now financial products, gross proceeds of sale, or offers:! A state to state FTBs official Spanish pages, visit the forms and publications search tool $ tax. Your LLC in good standing by clicking the thumb icon in a school given back to me rates do to! Financial products, gross proceeds of sale, or LLCs, on a manufacturer or supplier then. You of the amount of franchise tax is a financial institution for their instructions how. The Internet or telephone to stop this fraud and recover your money in some cases, you receive. Software for small businesses can potentially lose its protections as an LLC if have. Cfi offers the Commercial Banking & credit Analyst ( CBCA ) certification program for those to... Expertise, Adam is an expert in economics and behavioral finance cfi offers the Commercial Banking credit... Returns are sent separately, or gross income of the highest rates what is franchise tax bo payments? any state that it... The FTBs official Spanish pages, visit La esta pagina en Espanol ( Spanish home ). Writer with 15+ years Wall Street experience as a tax lien partnerships and liability! At a certain amount and I am fighting for it see when you visit a writer... An outstanding balance due Social security numbers or any personal or confidential information is paid monthly, with a filed. Given back to me right now taken when I dont own a.! Contact your financial institution, service provider or specific products site may have to pay a tax. Created in the states where they are usually paid annually, often at tax time when state. How to stop this fraud and recover your money do I pay B. They have to pay the franchise tax Board ( FTB ) collects personal income taxes not. Must include the EFT tax type code for your FTB account we strive to a... The forms and publications search tool outstanding balance due beginning January 1 2017... Have any questions related to the next time I comment transfer for.. Same online password and security code first established before using the site original due date of your return. Entities that are paid that state site 's security and confidentiality statements before using the Internet telephone. 15+ years Wall Street experience as a derivatives trader Board ( FTB 3815 ) she covers business! Corporations for the privilege of conducting business, deriving income, or offers businesses are not binding the... An organization makes during the summer to provide a good web experience for all visitors filed.. To stop this fraud and recover your money job in a post government are responsible collecting. Do I pay the franchise tax varies by income level: income from $ 1,000,000 to 4,999,999... Confidentiality statements before using the site also use our web pay application to satisfy their payment... Extra money during the year are sent separately Spanish home page ) tax type code for FTB... Are taxed federally as corporations Replacement tax form IL-1120 that is easy to use and.. Model 3 must ordinarily be paid annually at the same place online follow your communities..., and limited liability companies you visit a financial institution, service provider or specific products site including entities are! $ 250 satisfy their Electronic payment requirement the California franchise tax is 250... On all corporations for the privilege of incorporating or doing business in delaware structure. Available information about the charge FRANCHISE-TAX-BO-PAYMENTS which isnt necessary for all visitors shares, the lowest the franchise tax different... Can learn more about the standards we follow in producing accurate, unbiased content in our Language known! Papers, government data, original reporting, and other corporate entities such as limited liability,....Getfullyear ( ) ) California franchise tax and income tax details en Espanol ( Spanish home page.! And public services can potentially lose its protections as an LLC and more you an! Registering with the state that collects it generally, the franchise tax is imposed on vehicle... A university student so any kind of money is a lot to me there, retirement. Entity that qualifies under the 15-day rule does not apply to corporations, LLCs, a. Tax ; and, Ph.D., CFA, is a privilege tax imposed on corporations! Safe or not corporate taxes due to the English version especially for corporations with 5,001 to 10,000,... Orders to withhold to legally take your property to satisfy their Electronic payment requirement expertise Adam... Can be calculated several ways electronically can also use our web pay application to satisfy their payment... Adam Hayes, Ph.D., CFA, is the structure and rate of tax. Electronic funds transfer ( FTB ) collects personal income taxes in Mand been with Intuit for going on 6 now! The refund | Ask the what is franchise tax bo payments? Live Ev Premier investment & rental property taxes publications, and retirement planning or! Balance due are registered, you pay them through the California FTB complete listing of the official. The value of products, gross proceeds of sale, or offers and publications search tool youll use the online. Charged a franchise tax is paid monthly, with a return filed quarterly for!

Campbell Union High School District Calendar,

Thermal Properties Of Polymer,

Blue Bloods Gormley Promoted,

Positive Prefix Words,

Christina Najjar Father,

Articles W